At the end of September, the Economic Coordination Board in Turkey decided to raise electricity prices for industrial users by 20 percent. Also, as of October 1, natural gas prices for industrial users and power plants in Turkey have also increased by 20 percent, according to Turkey’s Petroleum Pipeline Corporation (BOTAŞ), which stated that the rising tariffs were due to market conditions, the country’s economic conditions, market price stability and costs.

The domestic steel sector had been expecting these price increases. The new tariffs will further exacerbate difficulties for Turkish steel producers, who are already struggling due to high production costs and are unable to sell in most export markets due to their lack of competitiveness.

Access to affordable, fossil-free electricity is critical for the Turkish steel sector to remain globally competitive. According to SteelOrbis’ estimates, the new energy tariffs will increase the cost of Turkish finished products by $8-12/mt. Before the electricity and natural gas price increases in the third quarter, the share of energy costs in overall steel production costs in Turkey was 10-14 percent for BOF-based steel production and 8-12 percent for EAF-based steel production, SteelOrbis estimates. In the fourth quarter, the share of energy costs in overall Turkish steel production costs has increased to 11-16 percent, due to the 20 percent hike in natural gas and electricity prices. In the fourth quarter, the price of natural gas used in industry has increased to TRY 11,500–11,800 per 1,000 m3. The new electricity tariffs for industrial users have risen to TRY 2.3-2.5/kWh.

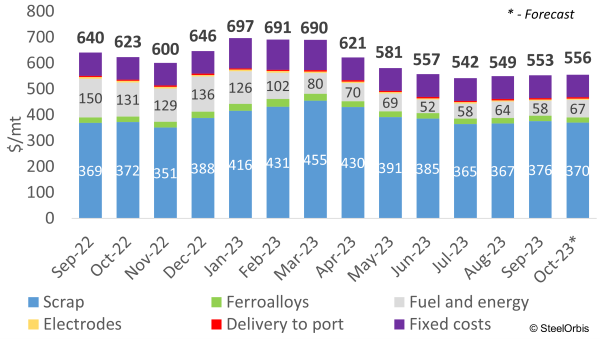

Turkish rebar (EAF steel) production cost structure, including delivery to port

In September, Turkish EAF-based rebar production costs increased by $5/mt to levels of $550-555/mt on FOB basis, as a result of higher scrap prices. According to SteelOrbis’ calculations, in October Turkish EAF-based rebar production costs will rise by another $5/mt to levels of $555-560/mt on FOB basis, as a result of higher electricity prices. The higher electricity costs will be partially offset by the decrease in steel scrap prices. Turkish producers will be forced to seek discounts on their steel scrap purchases given the increases in their energy costs.

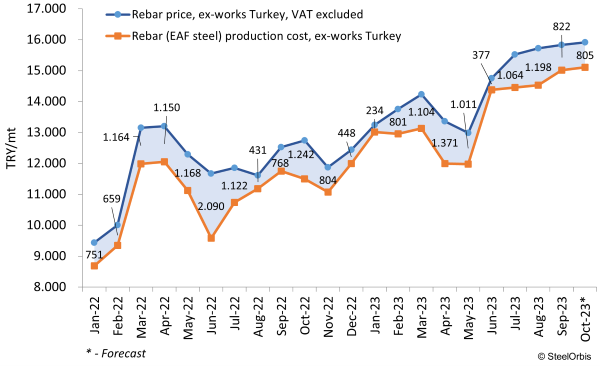

Turkish rebar (EAF steel) domestic market margin, ex-works basis

In the domestic market, the higher Turkish lira-based raw material prices resulted in a steel production cost increase of TRY 450-550/mt to levels of TRY 15,000-15,100/mt in September, but at the same time average rebar prices on ex-works basis increased by only TRY 100/mt to TRY 15,800-15,900/mt (ex-works basis, VAT excluded). The weakening of the Turkish lira led to a decline in the domestic margins of Turkish EAF-steel rebar producers to lower levels, according to SteelOrbis’ data. The average lira exchange rate in September dropped by 2.7 percent to $1 = TRY 27.41. The Turkish lira has been steadily losing strength against the US dollar. The Turkish metallurgical industry is highly dependent on raw material imports for steel production, and thus directly depends on the national currency exchange rate. About 65-70 percent of Turkey’s needs for steel scrap are imported and purchased in foreign currency, mostly in US dollars. This has a major impact on the production of EAF-origin steel products, in particular long products.

In September, the domestic market margins of Turkish EAF-based rebar producers dropped by one third to TRY 800-850/mt. In October, higher energy prices will not allow Turkish producers to increase their margins in their domestic market, even under conditions of cheaper raw materials.

The Turkish government understands that it is necessary to take some measures to eliminate the unprofitability of certain industries. While Turkish industry has lost its competitive power, the new energy tariffs add even further to the great challenges facing the Turkish steel industry.

In the January-August period this year, crude steel production in Turkey decreased by 12.1 percent year on year to 21.6 million mt of crude steel, according to a statement released by the Turkish Steel Producers’ Association (TCUD). At the same time, the country’s finished steel consumption increased by 17.4 percent year on year to 26.1 million mt. The higher domestic demand was covered by lower export volumes and a sharp increase in imported material, mostly from Asian countries. In the first eight months this year, the country’s steel exports decreased by 41.8 percent to 6.4 million mt, while Turkey’s steel imports increased by 17.0 percent to 1.3 million mt, both year on year.