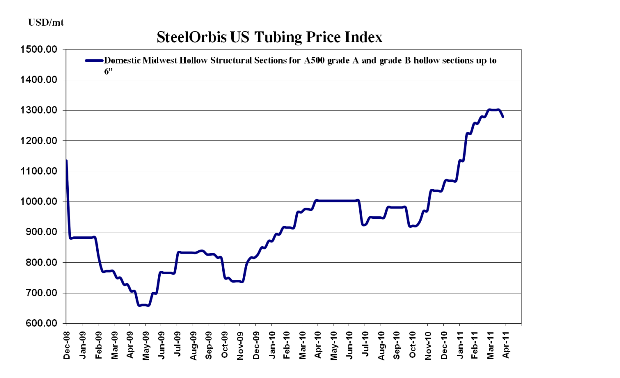

A portion of the most recent price increase from US domestic mills on hollow structural sections (HSS)-announced in late-February-has begun to erode, and further softening may be in the HSS market's future.

Only about $1.50 cwt. ($33/mt or $30/nt) of the late-February-announced $3.00 cwt. ($66/mt or $60/nt) price increase is still being reflected in US domestic HSS spot prices. If the increase had been fully absorbed, spot prices would have risen to approximately $60.00-$61.00 cwt. ($1,323-$1,345/mt or $1,200-$1,220/nt) ex-Midwest mill, however, with spot prices for US domestic hot rolled coil (HRC) falling $2.00 cwt. ($44/mt or $40/nt) to $40.00-$42.00 cwt. ($882-$926/mt or $800-$840/nt) ex-Midwest mill in the last week, buyers are finding it easier to negotiate lower HSS prices at the mill.

Industry insiders point to a glut of HSS inventories at tubing mills as another culprit for wavering HSS spot prices, evidenced by the fact that late April rollings continue to be available at a number of mills. US domestic HSS spot prices have fallen about $1.00 cwt. ($22/mt or $20/nt) since our last report two weeks ago to $57.00-$59.00 cwt. ($1,257-$1,301/mt or $1,140-$1,180/nt) ex-Midwest mill, with most orders being placed closer to $57.00-$58.00 cwt. ($1,257-$1,279/mt or $1,140-$1,160/nt) ex- mill. SteelOrbis has also heard of a few orders for larger tonnages being placed even slightly below the low end.

West Coast tubing prices also appear on the verge of a downward adjustment. Tubing mills on the West Coast were expected to increase prices following price increases from flat-rolled mills in March, but considering slow HSS activity and price deterioration already apparent in the Midwest, predictions of such an increase have quieted. Spot prices for HSS are still about $58.00-$59.00 cwt. ($1,279-$1,301/mt or $1,160-$1,180) ex-West Coast mill-as they were two weeks ago-and seem stable for the time being. However, spot prices will begin to soften sooner rather than later, with at least a $1.00 cwt. decline likely by mid-May.

With the US tubing trend pointing downward, traders are finding difficulty in convincing buyers to book even significantly discounted import offers. While SteelOrbis is aware of a few orders being placed slightly under the Turkish offer of $47.50-$48.50 cwt. ($1,047-$1,069/mt or $950-$970/nt) duty-paid FOB loaded truck in US Gulf ports, lead times are too far out (July) for most to even consider imported material.

South of the border, Mexican tubing offers are still $50.00-$51.00 cwt. ($1,102-$1,124/mt or $1,000-$1,020/nt) FOB loaded truck in US Gulf ports and $53.00-$54.00 cwt. ($1,168-$1,190/mt or $1,060-$1,080/nt) FOB loaded truck in US West Coast ports. Sources indicated that Mexican mills will attempt to continue holding prices level, although in order to remain competitive, once US HSS prices soften further Mexican mills will mirror the movements of their northern neighbor and adjust prices downward as well.