Tubing mills are trying to hold hollow structural sections (HSS) prices steady despite falling hot rolled coil (HRC) costs, but a major movement downward is imminent.

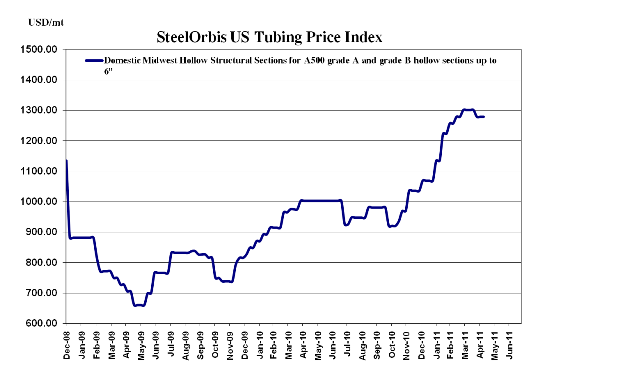

Severe damage to one tubing mill in Alabama in late-April due to severe tornado storms halted production-with an official restart date for operations still undetermined. While the unexpected shutdown caused a number of delayed and cancelled orders, sending buyers scrambling to find another source for the material, the incident has not yet affected pricing. After falling about $1.00 cwt. ($22/mt or $20/nt) in late April, US domestic HSS spot prices are unchanged this week at $57.00-$59.00 cwt. ($1,257-$1,301/mt or $1,140-$1,180/nt) ex-Midwest mill.

Sources tell SteelOrbis that although HRC spot prices are moving downward, and have for over a month now, most tubing mills are only now receiving the HRC orders they placed when spot prices were $43.00-$45.00 cwt. ($948-$992/mt or $860-$900/nt) ex-Midwest mill, and are therefore reluctant to make too many deals too quickly. But holding prices level now delays the inevitable, said one Southeast distributor, and with HRC spot prices expected to fall below $40.00 cwt. ($882/mt or $800/nt) in the not-so-distant future, HSS prices will have more drastic of a fall in late spring.

Tubing mills on the West Coast aren't cutting too many deals just yet either. A few deals under the spot price range of $58.00-$59.00 cwt. ($1,279-$1,301/mt or $1,160-$1,180/nt) ex-West Coast mill-as it was two weeks ago-have been heard, but a price correction on the West Coast likely won't come until late Q2, especially since West Coast tubing mills never issued a price increase to match flat-rolled mills' $2.00 cwt. ($44/mt or $40/nt) May increase that put HRC spot prices at about $46.00-$47.00 cwt. ($1,014-$1,036/mt or $920-$940/nt) ex-mill. HRC prices did fall to $42.00-$43.00 cwt. ($926-$948/mt or $840-$860/nt) ex-West Coast mill on the spot market last week however, signifying a substantial drop-likely at least $4.00 cwt. ($88/mt or $80/nt)- in West Coast HSS prices toward late June.

One thing US tubing mills don't have to worry about is stiff competition from imports. For buyers looking to fill inventory holes and need just-in-time deliveries, Mexican offers are still the most attractive at $50.00-$51.00 cwt. ($1,102-$1,124/mt or $1,000-$1,020/nt) FOB loaded truck in US Gulf ports and $53.00-$54.00 cwt. ($1,168-$1,190/mt or $1,060-$1,080/nt) FOB loaded truck in US West Coast ports. But futures activity is still light. Turkish offers of HSS to the US have risen $1.00 cwt. ($22/mt or $20/nt) to $48.50-$49.50 cwt. ($1,069-$1,091/mt or $970-$991/nt) duty-paid FOB loaded truck in US Gulf ports since our last report two weeks ago, and further increases are expected.