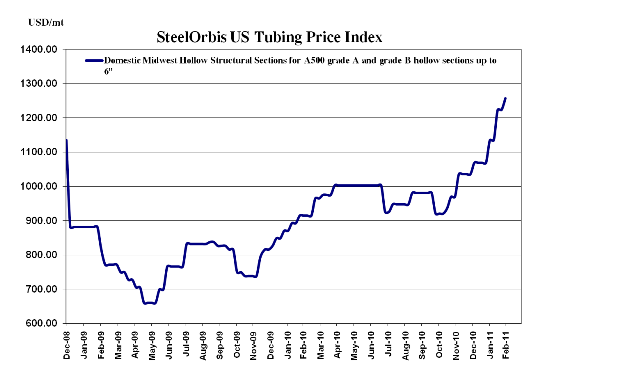

The most recent (announced in mid-February) hot rolled coil (HRC) increase of $30-$50/nt, depending on the mill, is being absorbed into the spot market faster than many had anticipated, causing prices the US domestic tubing market to move quickly as well. Following the $3.00 cwt. ($66/mt or $60/nt) HSS increase announced on February 25 (effective with all new orders), mill asking prices are now approximately $59.00-$60.00 cwt. ($1,301-$1,323/mt or $1,180-$1,200/nt), and spot prices are already beginning to reflect the uptrend.

The most commonly reported spot ranges are up $2.00 cwt. ($44/mt or $40/nt) on the low end and $1.00 cwt. ($22/mt or $20/nt) on the high end since our last report two weeks ago, and are now around $56.00-$58.00 cwt. ($1,235-$1,279/mt or $1,120-$1,160/nt) ex-Midwest mill. The usual two to three week time period between announced increases and the absorption of those increases into spot prices has shortened, and spot ranges from tubing mills in the Midwest are expected to be in the $57.00-$60.00 cwt. ($1,257-$1,323/mt or $1,140-1,200/nt) ex-mill range within the next seven to 10 days.

The same can be said on the West Coast; West Coast mills have traditionally raised prices about two weeks after Midwest producers do so, however, sources have reported to SteelOrbis that West Coast mills may be ready to issue an immediate price increase of $3.00 cwt. as soon as this week. For now, spot prices are still in the $56.00-$57.00 cwt. ($1,235-1,257/mt or $1,120-$1,140/nt) range, with most orders being placed at the higher end.

Although prices are moving up quickly at the mill level in the West Coast and the Midwest, prices from service centers still lag behind mill increases by at least one month. January was a strong month for many domestic distributors, however February activity wound down slightly, and March activity is expected to be even slower, as few-if any-are still purchasing anything beyond what is immediately needed. That's not to say that there aren't a few bright spots in demand still in the market-the agricultural equipment sector is still strong, and manufacturing activity continues to improve-but improvements in those areas are simply "not enough to go around" according to service center sources in the Midwest.

And so, interest in offshore product remains light. While Turkish import offers of $51.00-$53.00 cwt. ($1,124-$1,168/mt or $1,020-$1,060/nt) duty-paid FOB loaded-truck in US Gulf ports could become attractive to US buyers, especially considering the latest increase in US domestic prices, Turkish sales prices into the US are expected to increase in the coming weeks, likely making them too high to interest potential US buyers.

Import activity on the West Coast is quiet as well with the exception of offers from Mexico. Current HSS offers from south of the border are approximately $52.00-$54.00 cwt. ($1,146-$1,191/mt or $1,040-$1,080/nt) FOB loaded truck in US West Coast ports, however those prices are expected to move up in sthe coming weeks once US West Coast mills raise price in the coming days.