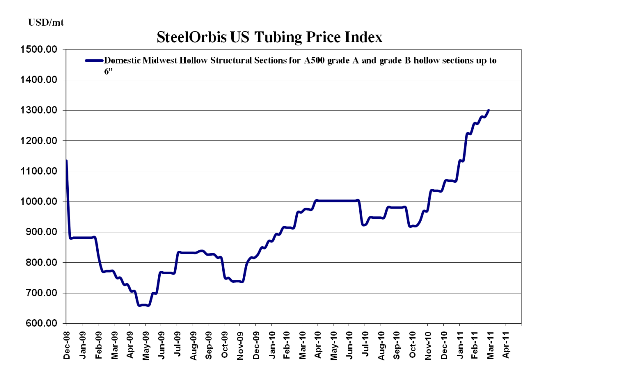

Although tubing spot prices have moved higher, the trend may only be temporary as flat-rolled prices are beginning to feel downward pressure.

A portion of the most recent price increase announced by US domestic tubing mills for $3.00 cwt. ($66/mt or $60/nt) in late February is being reflected in spot price ranges this week. US domestic tubing deals below this week's spot ranges are not difficult to come by however, especially if a buyer is willing to book considerable tonnage. But for the most part, the most commonly reported domestic spot prices are $58.00-$60.00 cwt. ($1,279-$1,323/mt or $1,160-$1,200/nt) ex-Midwest mill, a $1.00 cwt. ($22/mt or $20/nt) increase over previously reported spot ranges two weeks ago.

Hot rolled coil (HRC) spot prices are peaking at $43.00-$45.00 cwt. ($948-$992/mt or $860-$900/nt) ex-Midwest mill and will likely decline in the not-so-distant future. And so, because "mill executives know the HRC market is close to changing direction, they're enforcing their latest increases while they still can" commented one distributor in the South.

On the West Coast, tubing mills never officially followed the late February price increase in the Midwest, but rather raised spot prices incrementally over the past month. Compared to late February spot prices, HSS is now up $1.00 cwt. on the low end and $2.00 cwt. ($44/mt or $40/nt) on the high to this week's range of $57.00-$59.00 cwt. ($1,257-$1,301/mt or $1,140-$1,180) ex-mill. This week's spot prices also reflect a $1.00 cwt. increase on the high end from our last report two weeks ago.

Spot prices will likely continue to climb in April on the West Coast with a $2.00 cwt. ($44/mt or $40/nt) price increase expected in the immediate future on the heels of the latest flats price hike. Flat-rolled mills on the West Coast raised prices $2.00 cwt. in mid-March that brought HRC to $46.00-$48.00 cwt. ($1,014-$1,058/mt or $920-$960/nt) ex-mill.

Offshore, due to a weak domestic HSS market in Turkey, offers have fallen approximately $2.50 cwt. ($55/mt or $50/nt) in the past two weeks to $50.50-$51.50 cwt. ($1,113-$1,135/mt or $1,010-$1,030/nt) duty-paid FOB loaded truck in US Gulf ports. US buying activity from Turkish mills is relatively non-existent however, and the longer lead times (May shipment/June delivery) are too far out with US domestic price uncertainty mounting.

Elsewhere, there is still moderate interest in tubing offers from south of the border. While Mexican offers of HSS are expected to increase in early April, current offers still stand at $50.00-$51.00 cwt. ($1,102-$1,124/mt or $1,000-$1,020/nt) FOB loaded truck in US Gulf ports and $53.00-$54.00 cwt. ($1,168-$1,190/mt or $1,060-$1,080/nt) FOB loaded truck in US West Coast ports.