The common stocks of steel companies and their raw material suppliers have underperformed the stock market this year. For the first 26 weeks of the year, our composite index was down 18 percent while the S&P 500 common stock index rose 7 percent.

The owners of steel and steelmakers' raw material common equities have been faced with a handful of problems. First, most of the companies' earnings have come down. Second, some of the steel companies' assets have been put up for sale at bargain basement price levels (which raises questions about the true value of those assets not for sale). Third, banks and other sources of lending have often not been willing to make funds available at attractive price levels to steel companies and steel middleman companies. Fourth, it's been clear that fixed asset investment spending outside of China has been lagging, which is bad for steel demand on a one- to two-year basis. Fifth, oversupply for steel in China has probably become the normal condition; if so, the Chinese steel mills will be taking more aggressive actions to boost export sales over the cycle.

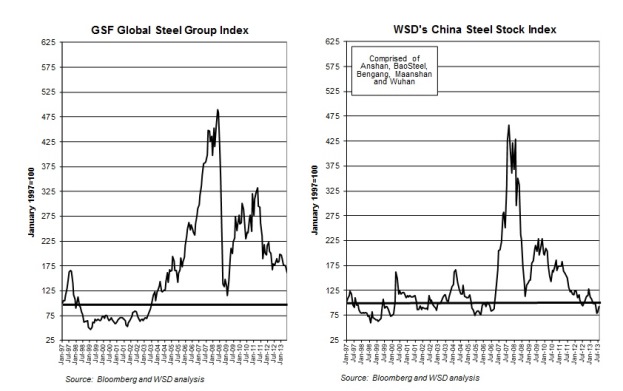

The Global Steel Finance (GSF) global steel stock index has been declining since mid-2011, falling 39 percent from a peak index figure of 293 to 178 at present. During this period, the S&P 500 Index has risen 23 percent from 168 to 208. Virtually all of the steel-related sub-sectors have performed poorly including those for steel companies in the Far East , Brazil, Europe, Russia, Japan (although recovered somewhat recently) and the US.

- The Steel Middleman Index has performed far less badly than those for the iron ore companies and coking coal companies. Its current price is 224, which is a bit down from July 2011.

- The Iron Ore stock index is down from a 2011 high of 885 to 462 at the present time; although, it's still far above the index figure of about 100 from 1997 to 2003.

- The coking coal producer index is down from 900 to 101; or, about where it was in the period from 1997 to 2004.

- The Chinese steel mill index is low from a peak of 457 in September 2007, to currently 92.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2013 by World Steel Dynamics Inc. all rights reserved