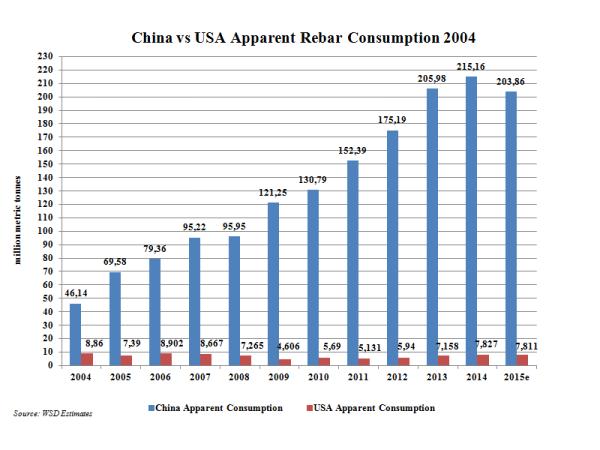

As indicated, 2014 apparent rebar consumption in China at 215 million mt was 27 times the USA figure at 7.83 million mt. This year, apparent rebar consumption in China may decline by 12.5 million mt to 204 million tonnes and be flat in the USA; however, the Chinese figure is still 26 times the USA one.

The reason for the disparity, of course, is that fixed asset investment in China, after adjustments, accounts for about 50 percent of GDP, with the steel intensity of the economy being remarkably high when FAI is at such a high level.

In 2004, as indicated, Chinese apparent rebar demand at 46 million tonnes compared to 8.86 million mt for the USA – or, 5.2 times the USA figure.

What do these figures demonstrate? To us, they demonstrate among other things, the validity of the “Capital Fundamentalism” economic theory which postulates its fixed asset spending that drives the growth of an economy. There are exceptions, of course, such as the amazing growth of the service sector in India to 55 percent of GDP from about 38 percent a decade ago because of the power of the Information Revolution.

China’s surge in fixed asset investment has been enabled in good part because of the low interest rates for manufacturing and construction companies when borrowing from the country’s government-owned banks. One of the consequences of this policy was to keep interest rates on deposits unnaturally depressed, which held down household spending as a share of GDP.

China is now in a condition in which the government, even though theoretically speaking, it is determined to boost household spending as a share of GDP, is once again turning to infrastructure projects as a means to bootstrap the economy. It’s more difficult to have as big an impact as in the past. However, because: a) the housing sector in the country is seriously overbuilt; b) municipalities already are burdened in most cases with excessive debt; and c) many of the manufacturing and construction companies are overextended on a financial basis.

If adjusted FAI were to zoom to 58 percent of GDP in the next two years, this means that Chinese steel demand will be higher than forecast and that the potential fallback in demand is even more substantial.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2015 by World Steel Dynamics Inc. all rights reserved