2022 boom year for steel

The global economy is probably in the midst of a multi-year recovery – as was the case after the late 2008 global financial crisis.

WSD expects the global economy next year to be stronger than in 2021, especially from the perspective of the steel industry that’s a “late-in-cycle” industry (given its tie-in to fixed asset investment that normally gets stronger the longer the economic recovery). Some other positives for steel demand may include:

- Many industrial companies outside of China will have fully resumed their capital spending programs. In 2020, capital spending in many cases was scaled back due to much reduced profits, some weakening of their balance sheets, tougher-minded banks when it comes to obtaining loans, and less confidence in the supply/demand balance for their products. In 2021, capital spending by industrial companies may lag that in 2020, when many projects were deferred – and, it often takes at least six months for these to be rekindled.

- Governments will have more funds available in 2022 for infrastructure spending as their deficits are lessening, fewer funds are transferred to needy citizens and sales and income tax revenues are rising. In 2021, persistent government deficits and high transfer payments to the unemployed and less fortunate will probably be “crowding out” outlays for infrastructure spending.

- Consumers will have more optimism granted that the COVID-19 Pandemic is no longer pulling down the global economy – reflecting the benefit of widespread vaccinations. (Note: We presume that non-vaccinable new variants of COVID-19 won’t appear and that there will be few issues with the effectiveness of the currently available vaccines.)

- The oil price could rebound to $60-65 per barrel, reflecting rising demand and OPEC production restraints. If so, this would probably stimulate some increase in oil well drilling activity and the restart of infrastructure projects in the Middle East. (Note: Of course, the oil price outlook is always a “wild card.”)

- Inflation rates may remain low in many countries, despite persisting government deficits, due to “competitive” pricing in many industries and still moderate wage boosts.

- Interest rates on government bonds will likely remain quite low. One reason, perhaps, is the sizable excess supply of money circulating the world looking for better returns. Until these better returns are found, a sizable portion of these funds may remain “parked” in highly liquid governmental bonds – including the USA’s 10-year treasury bond that currently yields about 1%.

- China’s policymakers in China may be: a) less fearful of a housing price bubble; b) not as worried about the excess debt held my municipalities – a good portion of which will be refinanced in 2021; and c) confident that the country’s merchandise exports will continue to boom. In November and December of 2020, the country’s net trade surplus amounted to about 6% of GDP.

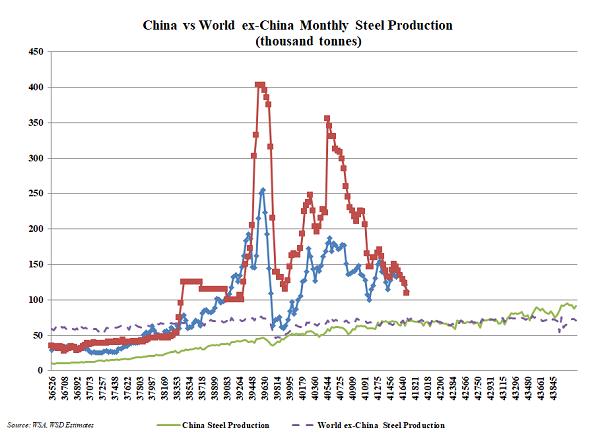

In 2022, given a 4% rise in non-Chinese apparent steel demand, little change in Chinese steel demand, China’s net steel exports at about 30 million tonnes (versus 33 million tonnes in 2020) and Chinese steel production restricted by its government to 2020’s level of 1.05 billion tonnes, non-Chinese steel production would need to rise to about 960 million tonnes (versus 870 million tonnes in 2019, 802 million tonnes in 2020 and about 920 million tonnes in 2021). A rise in production in 2022 to this level would probably be sufficient for many steel mills to have enough “pricing power” to more than pass on their costs.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non -public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2021 by World Steel Dynamics Inc. all rights reserved