2024 has been one of the most challenging years for the global steel industry, with one of the main reasons being the crisis in the Chinese steel market. SteelOrbis has collected opinions from market participants about the main trends in the Chinese steel sector in 2024 and their expectations regarding whether these trends will remain or dissipate in 2025.

Facts about Chinese steel sector in 2024:

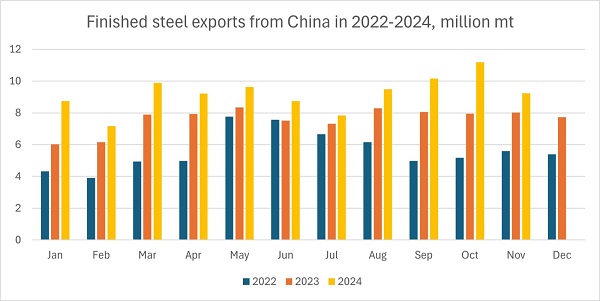

- In January-November, China’s finished steel exports totaled 101.152 million mt, up 22.6 percent year on year.

- Chinese steel exports in 2024 to reach 110 million mt or just slightly below

- Sheet/plate exports totaled 68.75 million mt in January-November, up 26.5 percent year on year.

- In January-November, steel bar exports reached 11.99 million mt, up 19.1 percent, while wire rod exports amounted to 2.39 million mt, increasing by eight percent, year on year.

- Non-VAT trading limited, but not gone

- Apparent crude steel production down by 5.1 percent in January-November

- China’s iron ore imports reached 1.124236 billion mt in January-November, up 4.3 percent

Steel exports increase to near record high, non-VAT trading declines

Chinese mills and traders have been active in steel exports in 2024, with flat steel sales posting the highest growth. The market participants polled by SteelOrbis assess the current year’s increase in exports as a part of the current market fundamentals, where weak local demand and high production have resulted in an increase in exports for at least the past three years. In particular, in 2023 steel exports had surged by 36.2 percent year on year to 90.3 million, so in general overseas shipments will remain at high levels of 90-110 million mt in 2023-2025, and only after this period may exports be seen at a lower level.

“There is an unfavorable situation regarding exports of low-priced steel (especially of non-value-added material) and it may come under supervision, which would regulate China’s crude steel output, while also curbing the relatively high raw material prices,” a representative of a top five Chinese steel mill told SteelOrbis. He added that China’s finished steel export volume may see a year-on-year decrease of 9.0-9.5 percent in 2025. According to different assessments, steel exports from China in 2024 are expected to be in the range of 107-110 million mt. A few other sources, both from traders and mills, foresee Chinese exports being lower by 9-11 percent next year, while still remaining higher compared to 2023.

Traders offering and selling cheaper non-VAT Chinese steel to the market became a new normal in 2023. But, since July 2024, active inspections resumed at Chinese ports to find non-VAT volumes, mainly of wire rod and HRC. This led to delays in a number of shipments and traders were more cautious in terms of offering low prices. According to market sources, in the third quarter this year only 40-50 percent of the traders previously working with non-VAT business continued to do so, while this number was down further to 20-30 percent by the end of this year.

“Non-VAT exports will be further regulated. For instance, Chinese customs may be uniformly strict in requiring exporters to show proof of duty payment in the first quarter of next year. Meanwhile, export traders will face risks of late payments of back taxes and will face penalties, which will make them avoid similar behavior,” a major Chinese steel trader told SteelOrbis.

Based on the current international conditions, overseas trade barriers will be increased and the anticipated stronger pressure from tariffs will exert a negative impact on Chinese steel exports in 2025, exerting far stronger pressure than the limitation of non-VAT trading.

Competition tough, AD investigations against China intensify

In 2024, there were 26 trade investigations initiated against Chinese steel products, three times higher than in the previous five years. HRC and flat steel products will be impacted the most. Most of the investigation results will be seen in 2025, with the most important being the case against Chinese HRC in Vietnam.

In the January-September period of 2024, Vietnam imported 6.3 million mt of Chinese HRC, already surpassing the total imported in all of 2023. At the same time, local producers supplied 5.1 million mt of HRC in Vietnam during the same period. “Vietnamese HRC buyers have been very cautious in terms of new import purchases as all are waiting for the results of the antidumping investigation to be announced very soon, with some expecting them at the beginning of January,” a Vietnamese trader told SteelOrbis. Market sources expect tariffs of 20-24 percent for China, which will make a significant impact on the Chinese steel export total.

In the different segments, China will be impacted, on a smaller scale, in India, South Korea, Pakistan and Thailand.

However, there may be some supportive factors and an increase in Chinese sales to other sales destinations. “The depreciation of China’s currency may boost the competitiveness of Chinese exports, which will increase mills’ shares in some export markets,” a market source said.

China may face some competitiveness from ASEAN steel mills amid the rapidly increasing regional production capacities. As production capacity increases, the risk of oversupply in the market may intensify, as steel mills will compete for limited market demand, with distant markets such as the Middle East and Latin America possibly being impacted the most.

However, Chinese traders have stated that they are not afraid of competition, at least in the long steel markets, given their huge domestic production outputs and well-developed logistics systems. China’s One Belt One Road policy has helped the infrastructure and equipment manufacturing industries in the ASEAN region to continue their boom, which will result in increasing demand for rebar and wire rod year on year.

China’s steel consumption drops due to weak real estate sector

As regards the macro perspective, the global economy will continue to indicate relatively sluggish growth in 2025. China’s economic development is closely related to the policy direction of the United States, which signals that uncertainty will increase further.

Apparent crude steel production in China dropped by 5.1 percent year on year in the first 11 months of 2024 to 834.2 million mt, according to SteelOrbis’ calculations, mainly due to the drop in long steel consumption given the weakness of China’s real estate sector.

In 2025, the real estate sector will be the main factor constraining China’s economic growth and its demand for steel. Steel consumption by China’s real estate industry will likely decrease by 10-20 million mt in 2025, as indicated by at least two major Chinese steel mills, while other sources expect declines of at least 20-25 million mt, still slower than in 2024, when steel consumption by the real estate segment posted a double-digit percentage drop. Meanwhile, the apparent steel consumption of other industries, including infrastructure construction, the auto industry, the steel structure industry, home appliances and the shipbuilding industry may increase year on year, though demand from the machinery industry may continue to indicate a very slight decrease. As a result, China’s apparent steel consumption in 2025 may see a slight decline compared to 2024, of around 0.5-2 percent, depending on different sources, with the worst-case scenario envisaging a decline of up to three percent in steel consumption.