World Steel Dynamics has released the Executive Summary of Peter Marcus’ report on AutoBody Warfare: Aluminum Attack. Here are the major points:

1. Aluminum automotive sheet deliveries will show spectacular gains through 2018.

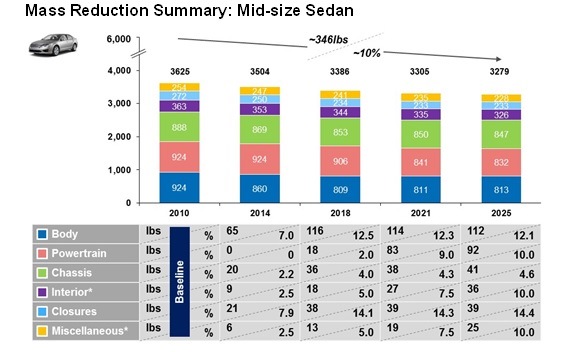

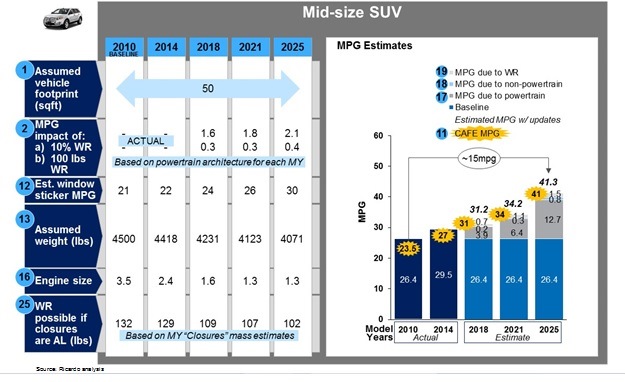

2. However, using steel products, the weight savings needed to meet the 2018 and 2021 CAFÉ standards for most vehicles can be easily achieved.

3. Aluminum sheet deliveries to the automotive market are likely to peak about 2018.

4. Reductions in a vehicle’s weight, surprisingly, do not result in major improvements in miles per gallon. A 10% weight reduction saves only 6-7% in gasoline used per mile.

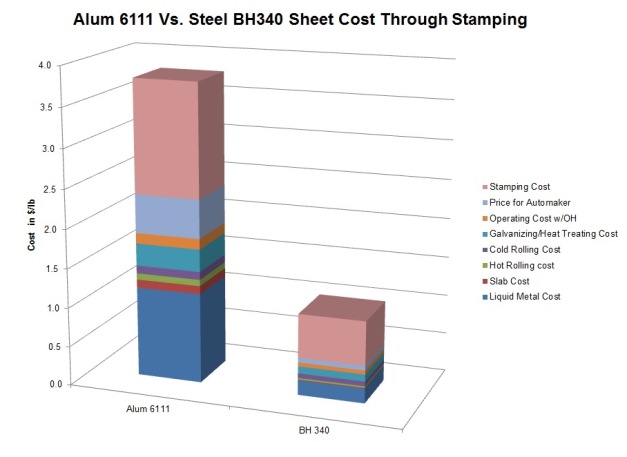

5. Aluminum automotive sheet is expensive. For the skin of the vehicle, 6111 alloy aluminum sheet, after stamping expenses and the scrap credit, costs the automotive company about $3.80 per pound versus $1.04 per pound for BH (bake hardenable) 340 megapascal (MPa) steel sheet.

6. Ford probably “jumped the gun” in 2009 when it decided to build an aluminum-bodied light truck. And, it may pay a price in terms of reduced profitability because of the high cost of its 2015 F-150 truck; although, the new truck is an extraordinary product. The world was changing so fast in 2009 that, in WSD’s opinion, no group could have fully anticipated the new developments in the next half decade.

7. The frenzy in the United States to invest in aluminum rolling mills and heat-treating lines to produce 6xxx alloy sheet will likely result in sizable oversupply of this product by 2018.

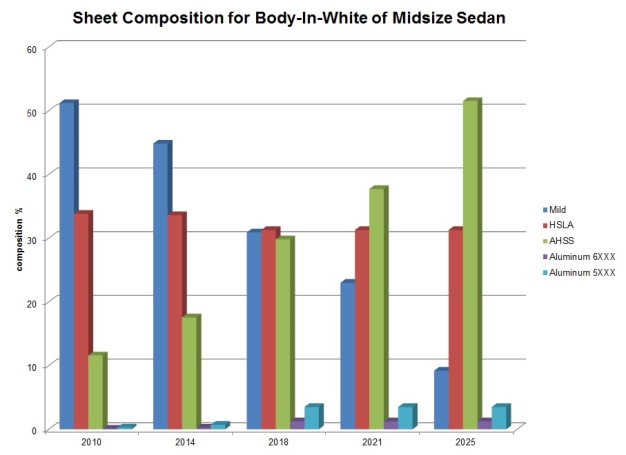

8. North American automotive steel sheet deliveries in 2025 may be only flat versus 2014 even assuming that vehicle production is up about 20% over this period. However, Advanced high-strength (AHSS) deliveries rise to 23.7 billion pounds from 7.4 billion pounds – a 330% gain, or 11.1% per year compounded.

9. The US steel mills are likely to obtain a higher profit margin on AHSS deliveries than their other automotive sheet products.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2014 by World Steel Dynamics Inc. all rights reserved