The trend for domestic hollow structural sections (HSS) is pointing upward after a number of Southern and Midwestern mills announced $2.00 cwt. ($44/mt or $40/nt) increases last week.

As a result of the $1.50 cwt. ($33/mt or $30/nt) hot rolled coil (HRC) price increase announcements earlier this month, Atlas Tube issued its own increase for HSS last Tuesday. By week's end, other mills in the South and Midwest, including Independence Tube Corp., Leavitt Tube Co., and Southland Tube Inc., had followed suit, and sent out price increase announcement letters raising their own transaction prices $2.00 cwt., effective immediately.

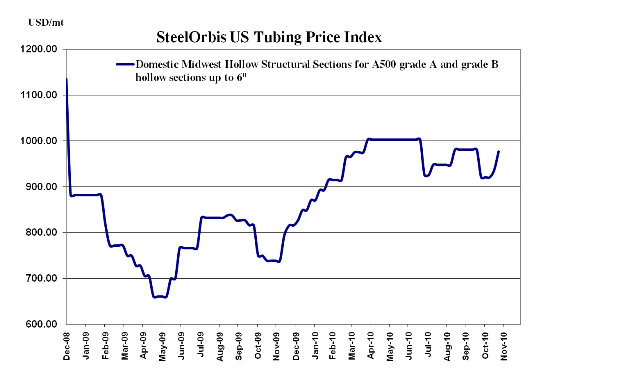

"This one is going to stick" commented one service center in the Southeast who added that mills are adamant about not repeating the failure of late September's $1.50 cwt. price increase announcement. Tubing spot prices ex-Midwest mill are up $2.00 cwt. from our last report two weeks ago and are now being reported between $43.00-$45.00 cwt. ($948-$992/mt or $860-$900/nt), and although industry players reported having been able to book large tonnage orders at below $43.00 cwt. a day or two after the announcement, it appears those deals are now no longer available.

Spot prices ex-West Coast mill, which usually take a week or two after Midwest increases to react, remain in the previously reported range of $45.00-$46.00 cwt. ($992-1,014/mt or $900-$920/nt). Late last week Evraz N.A.'s Oregon mill released its own $2.00 cwt. price increase announcement effective with all new orders, and although the increase has not yet altered the most commonly reported transaction ranges, West Coast increases are anticipated to stick quickly as well, with spot prices expected to be up to $47.00-$48.00 cwt. ($1,036-$1,058/mt or $940-$960/nt) delivered ex-West Coast by the end of the Thanksgiving holiday.

The domestic tubing market is anticipating yet another price increase announcement promised by a number of HRC mills, and is expected to react accordingly. Thus, purchasing activity may pick up in the coming weeks as a result of buyers choosing to plug inventory holes sooner rather than later, to avoid being forced to purchase product at even higher prices if they wait too long.

As with the last few weeks, import offers remain quiet. Korea, which was rumored to be attempting to re-enter the US market, has not made any offers due to concern over potential anti-dumping (AD) cases.

Looking to inventory from imports, preliminary license data from the US Steel Import Monitoring and Analysis System (SIMA) demonstrate that total import tonnage of structural pipe and tube is on the decline in November, and to date, only 9,216 mt have been delivered into US ports. October's imports were steady from months past at about 24,000 mt (License data). Imports from Canada and Korea appear to be experiencing the most significant monthly decline, with Canadian imports only totaling 4,344 mt as of November 22, compared to 12,094 mt in October; And month-to-date, only 519 mt of Korean imports of structural pipe and tube have been delivered into US.