Buying activity in the hollow structural sections (HSS) market has slowed as prices are rapidly trending upward and another price increase is expected any day now.

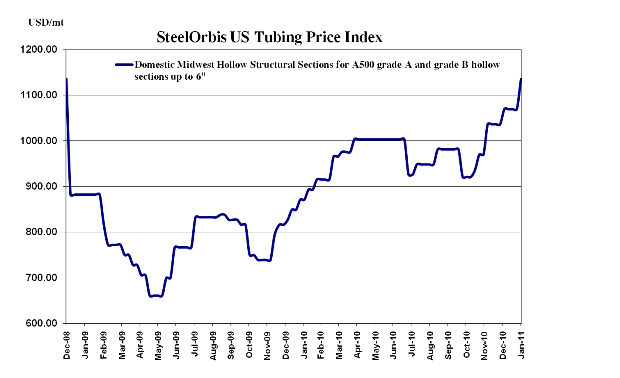

US domestic tubing spot prices in the Midwest have increased $3.00 cwt. ($66/mt or $60/nt) to $50.00-$53.00 cwt. ($1,102-$1,168/mt or $1,000-$1,060/nt) ex-mill over the last two weeks in reaction to mills' January 10-announced $3.50 cwt. ($77/mt or $70/nt) increase, however those offers are expected to dissipate by week's end as mills begin to implement their most recent price hike. The January 18-announced $4.00 cwt. ($88/mt or $80/nt) increase on all HSS products will be fully enforced for all February orders as rumblings of yet another increase looming in the not-too-distant future become more pronounced.

On the West Coast, spot prices have not yet reacted to the most recent increase in the Midwest, with the exception of Searing Industries, which immediately followed Atlas Tube's January 18-announced increase. Spot prices at Rancho Cucamonga, California-based Searing Industries are now around $56.00 cwt. ($1,235/mt or $1,000/nt), while spot prices from other West Coast tubing mills are still in the $52.00-$53.00 cwt. ($1,146-$1,168/mt or $1,040-$1,060/nt) ex-mill range. Sources tell SteelOrbis that like their Midwest counterparts, West Coast mills are not cutting deals despite a general slowdown in buying activity.

Rising costs continue to negatively impact HSS distributors, who are reportedly not purchasing product "unless it's already sold," and charging customers less for a product they have in stock than it will cost to replace it at current mill prices, in order to avoid losing market share. With HSS so rooted in the construction sector, a market expected to only slowly and marginally recover this year-construction unemployment has been consistently about double the national unemployment rate, and according to the Associated General Contractors of America (AGC), the industry's unemployment rate hit 20 percent in December compared to a 9.4 percent national unemployment rate- service centers continue to be stuck in the middle when prices go up. "When the market was strong, if mills went up $50/nt, so did we, but today's market won't accept our prices increasing in tandem with mills," explained one distributor in the South.

Looking offshore, import activity remains quiet as US tubing market is far too precarious for US buyers to take stock in product today not scheduled to arrive until after Q1. Some orders have reportedly been placed in past weeks, but demand levels in the US are still too slow from not only the construction industry, but from original equipment manufacturers (OEM's) and fabricators as well, to consider placing a large tonnage order overseas.