With Russia being the main pig iron exporter globally, any changes in its supply is a serious challenge to the worldwide supply chain, liable to cause disruptions, delays, and hikes in prices from alternative suppliers. At the same time, during the last five years, the share of Russian pig iron exports of total global pig iron exports has declined by more than ten percentage points, signaling that Russia has gradually been losing its market share, while other suppliers, on the contrary, have increased their shares, particularly Brazil and India.

In 2021, ex-Russia pig iron exports totaled 3.93 million mt, down from 4.82 million mt in 2017. Consequently, the share of Russian pig iron exports in the world's total pig iron exports decreased from 40.6 percent in 2017 to 29.6 percent in 2021. Meanwhile, Brazil's pig iron exports rose by 42 percent in this period to 3.24 million mt, while India's pig iron export shipments rose by 38 percent during the period to 904,232 mt in 2021. Having diversified their supply sources, global BPI customers appear to have mitigated the consequences from ex-CIS supply chain disruptions.

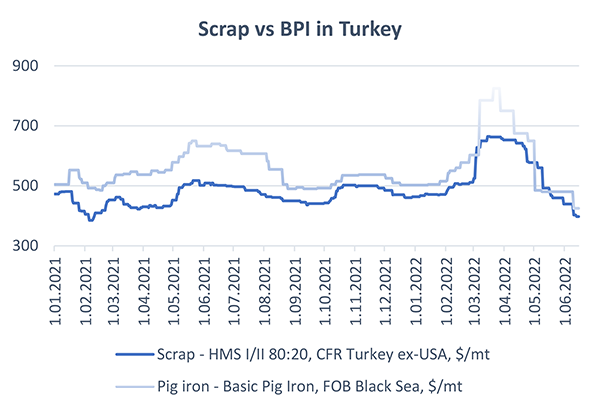

Following the beginning of Russia’s invasion of Ukraine on February 24, global demand for pig iron increased dramatically, arising mostly from growing concerns regarding the absence of ex-CIS offers, in particular from Ukraine where the production of pig iron was temporarily halted. The impact of the loss of ex-Ukraine pig iron supply has been intensified by two other developments, in particular, the sanctions imposed against Russia by North American, European, and Asian governments. The introduction of commercial and financial restrictions has drastically impeded the access of Russia’s pig iron to the global market, bolstering the positions of alternative suppliers, enabling them to increase their pig iron offers, with a certain success in concluding higher-priced deals. The Russian pig iron suppliers have had no other choice but to become accommodated to the new business conditions. In particular, Russian companies, which have an advantage in logistics, namely EVRAZ, Severstal and Tula started to offer BPI to China from their ports in Russia’s Far East region. However, considering that the prices in China have been much lower compared to the levels accepted by customers in other regions, transactions to that destination have been rather sporadic. Subsequently, Russian companies have focused on business with Turkish customers, benefiting from the decision of the Turkish government not to join the sanctions against Russia. Moreover, the increasing attractiveness of ex-Russia pig iron compared to import scrap has encouraged Turkish steelmakers to shift towards active bookings of pig iron.

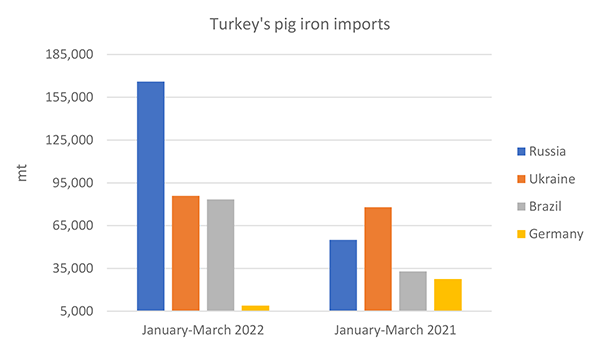

While in the January-March period this year Turkey imported 166,077 mt of pig iron from Russia, up threefold year on year, its pig iron imports since April are estimated to be even higher, given the rising flexibility of Russian BPI suppliers given their limited business opportunities amid sanctions, with Turkey being almost their sole outlet for exporting pig iron.

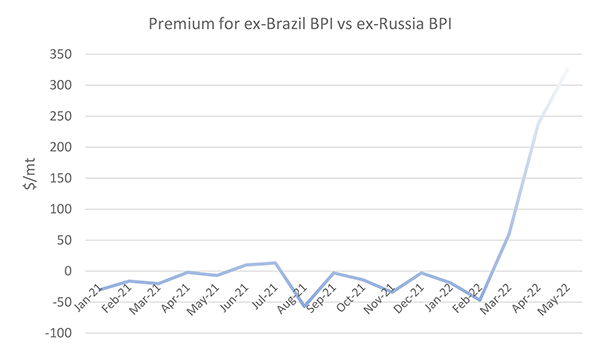

Aiming to secure export sales, Russian BPI mills have been forced to accept prices much lower than first-tier BPI suppliers have been offering. In May, the average premium for ex-Brazil BPI compared to ex-Russia BPI reached $326/mt. In particular, even in the end of May, when ex-Russia BPI sales were concluded at $470-490/mt FOB Black Sea, Brazilian BPI sellers were resisting any sales lower than $800/mt FOB (mostly having been guided by the latest ex-Ukraine BPI sale to the US at $830/mt CFR Port of New Orleans).

Sales at lower prices have not been a solution for all Russian BPI suppliers. Some Russian mills have opted to cut pig iron outputs and their presence in the export markets, citing low or zero margins from sales at the abovementioned low price levels. According to unofficial data, Russian steel mills have reduced their capacity utilizations by 50-60 percent, with Ukrainian mills on the territory temporarily occupied by Russia (namely, Alchevsk Metallurgical Complex (AMZ) and Donetsk Metallurgical Plant (DMZ) cutting production by more than 60 percent.

In particular, following the imposition of sanctions on Evgeny Borisovich Zubitskiy, the co-owner, chairman, and CEO of Russia’s Industrial Metallurgical Holding (IMH), the position of Tulachermet, a leading pig iron mill, has become highly unfavourable.

Likewise, Ural Steel appears to have faced serious problems supplying material to the export markets, though it no longer belongs to Metalloinvest, the major shareholder of which was punished by sanctions. The sale of Ural Steel to Zagorsk Pipe Plant (ZTZ) was completed on March 1.

Novolipetsk Steel (NLMK) has been left among a very few Russian companies exempted from restrictions, as its main owner Vladimir Lisin has not been punished by any sanctions of the EU, the UK or the US. Nevertheless, a number of uncertainties in terms of payment, logistics and customs clearance, not to mention the reputational risks of buying from Russia while the war in Ukraine continues, prevent the majority of leading BPI customers from doing business with the company.

Donetsk Metallurgical Plant (DMZ), a steel producing asset belonging to Ukraine and located in Donbass, but captured by Russia back in 2014, started to appear in the global market more often after Russia's invasion, but it has failed to make ends meet with low-priced sales. By the beginning of June, information about DMZ's intention to stop production appeared in the market more and more often, though some market insiders admit that, by such action, the company is aiming to prevent prices from recording a bigger decrease. According to estimations, the company is able to provide around 50,000 mt of merchant pig iron per month.

Ultimately, as long as Turkey and China collaborate with Russia, Russian suppliers are likely to continue their BPI export trade, despite being forced to accept prices lower than those offered by other global BPI suppliers. Moreover, taking into account SteelOrbis’ estimations of BPI production costs, ex-Russia BPI prices have not bottomed out yet, leaving room for further maneuvering.