Immediately after Russia’s invasion of Ukraine, European hot rolled coil and heavy plate re-rollers began to look for alternative slab sources and deals were concluded for slabs from Asia.

Steelmakers in southern and northern Europe were the most affected by the war because they relied heavily on raw material and slab supplies from Ukraine and Russia. Some were not able to access sufficient raw materials from either traditional or alternative suppliers, and others stopped bookings from Russia.

Ukrainian and Russian supplies were withdrawn from the global seaborne markets as steelmakers reduced outputs or halted operations due to the war, or as port blockades closed off shipping routes to the rest of the world. Buyers have also been wary of purchasing Russian slabs due to the sanctions on Russian oligarchs and their companies.

EU demand for imported slabs began to grow sharply from the beginning of March. Integrated coil producers, mainly from Italy, began to purchase imported slabs from China, India, Indonesia, Vietnam and Brazil to replace the missing semis volumes from Russia and Ukraine. Italy is the biggest and also a regular buyer of slab in the EU, particularly for hot rolled coil and plate production. In 2021, the country imported 2.57 million mt of slab, of which 75 percent originated from Ukraine, with the remainder mainly from Russia, according to the International Steel Statistic Bureau (ISSB).

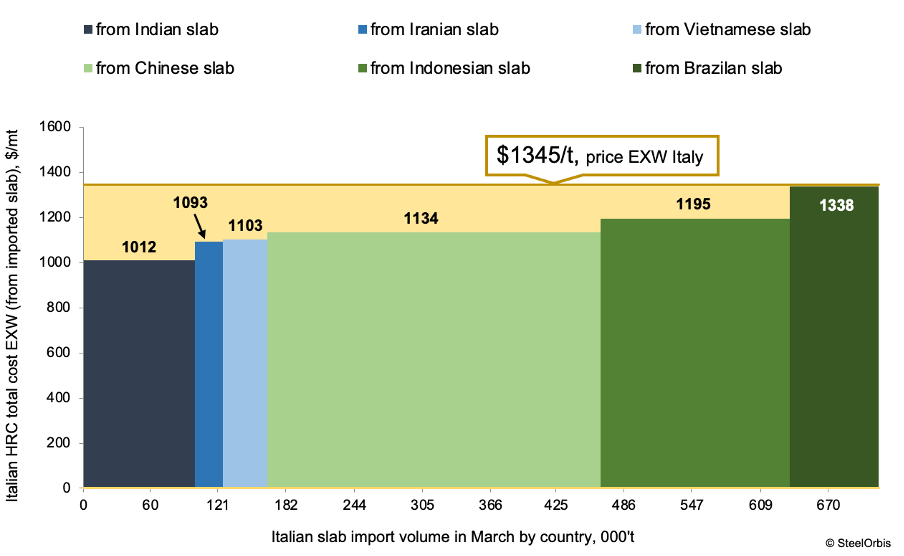

Market sources estimated that China has sent approximately 300,000-400,000 mt of slab to the rest of the world since the war started on February 24, particularly to Europe and Italy. In March, Europe booked more than 170,000 mt from Indonesia, 100,000 mt from India, 80,000 mt from Brazil, 40,000 from Vietnam and more than 20,000 mt of slabs from Iran.

According to SteelOrbis’ estimates, from March to early April Italian hot rolled coil (HRC) production costs from imported slab were in a rather wide range. Considering supplies from Asia only, the highest production cost of HRC was from Indonesian slab at about $1,200/mt, and the lowest was from Indian semis at $1,010/mt. There were also individual intercompany slab imports from Brazil, which marked the highest estimated cost of HRC production of $1,340/mt.

Italian HRC production cost from imported slab, Ex-works basis

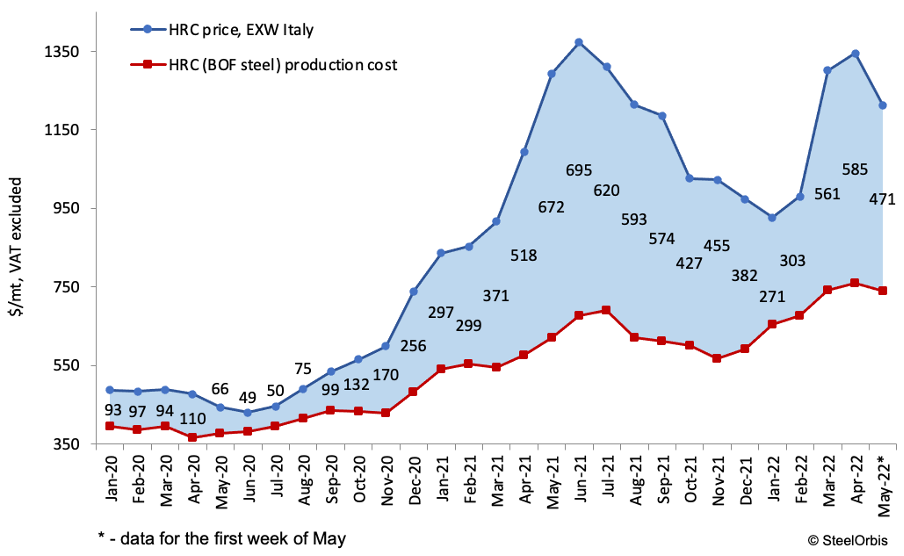

At the same time, Italian HRC production costs from BOF steel (integrated production) in March was $740/mt ex-works and $760/mt in April, SteelOrbis estimates. Over the same period, HRC export prices from Italy rose by almost $300/mt to $1,300-1,350/mt FOB. High rates of growth of steel product prices, triggered by war-related fears and risks, resulted in a 80-90 percent rise in Italian HRC margins over the past two months. In the March-April period, the profitability of Italian integrated producers increased by $200-280/mt to about $560-585/mt, SteelOrbis estimates.

Italian HRC (BOF steel) production cost and margin, ex-works

In the second half of April and in early May, HRC prices in the EU domestic market started to decrease at a rather quick pace. In the first ten days of May the price was around $1,180-1,220/mt ex-works, which is almost $130-180/mt below the April average. Distributors across Europe still have sufficient stocks and so they are not in a hurry to buy and prefer to wait in view of the ongoing downtrend of prices. At the same time, competitive import offers have continued to put downward pressure on domestic prices.

Meanwhile, HRC production costs decreased by only $20/mt due to lower declines in raw material prices. The profitability of Italian integrated producers in May decreased by $100-120/mt to about $460-480/mt, SteelOrbis estimates.

Demand from end-users has remained low and is not expected to improve significantly in the short-to-medium term, especially due to the crisis in the automotive sector. As a result, local HRC prices are projected to decrease further during May. At the same time, imports of Asian semi-finished products will remain relevant in the European market.

It is worth mentioning that in May buyers in the EU have significantly slowed down their import purchases of slabs, as the market has cooled off significantly in terms of HRC pricing and the mood of panic has eased somewhat. Some European companies are using their stocks and continue to receive earlier-booked tonnages. In the meantime, while Russia’s Severstal remains excluded from the EU markets, NLMK has restored its slab supplies to Europe as the company has been able to avoid the sanctions, at least for now. The regular monthly supplies of NLMK slabs to its European assets total around 130,000-150,000 mt.