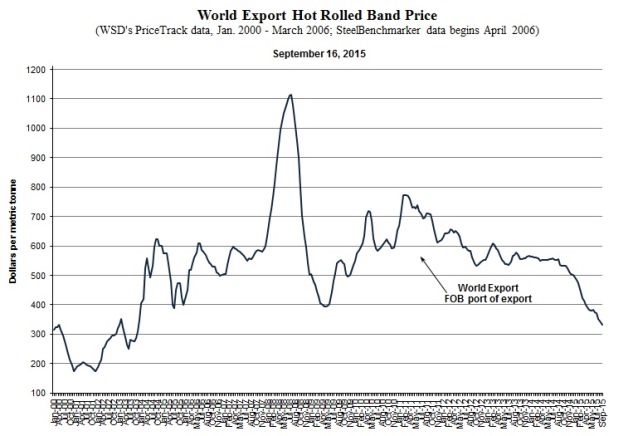

The current pricing “death spiral” pricing appears to be both the longest and the lowest price on record relative to the steel mills’ operating and marginal costs. Normally, the pricing death spiral phenomenon, whereby prices decline to the marginal cost of many steel mills, is a “short” age that lasts only a few months. This one started about April 2015.

The current death spiral is showing few signs of ending (which, of course, it will). Why?

• Sticky production on the downside because of mills’ low profit margins makes any production cutback quite painful financially.

• Competitive currency devaluations versus the U.S. dollar.

• Not much potential for a sizable rise in apparent steel demand when user inventory liquidations end because there was no massive excess of inventory to begin with.

• Chinese exports rose massively to a 120 million tonne annual rate in August 2015 versus 41-47 million tonnes per annum as recently as 2010-2011- a huge gain in market share for them in a 365 million tonne per year market.

• A rise in the number of steel mills deciding they must battle the Chinese mills for market share on the world market, including Pacific Basin steelmakers at coastal locations.

• A rapidly declining and flatter WSD monthly World Cost Curve

• Steel pricing anomalies:

-Slab versus billet pricing

-Home market versus export prices.

-Steel scrap prices versus the export prices of steel slab and billet.

-Steel scrap prices versus the prices of iron ore and metallurgical coal delivered to China.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2015 by World Steel Dynamics Inc. all rights reserved