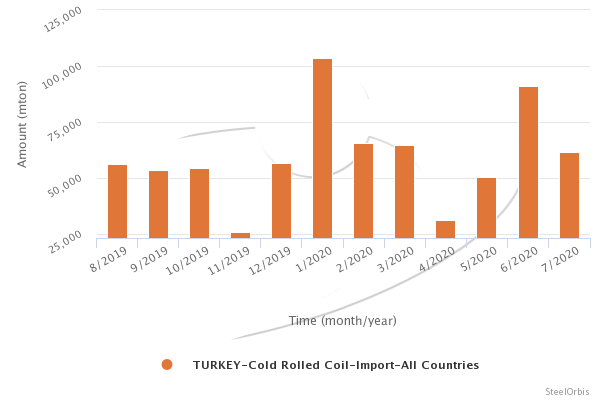

In July this year, Turkey's cold rolled coil (CRC) imports decreased by 32.4 percent month on month to 61,643 mt, up 2.4 percent year on year, according to the data provided by the Turkish Statistical Institute (TUIK). The value of these imports was $29.6 million, decreasing by 37 percent compared to June and down 18.1 percent year on year.

Meanwhile, in the first seven months of this year, Turkey's CRC imports amounted to 467,866 metric tons, up 19.5 percent year on year, while the revenue generated by these imports totalled $241.2 million, increasing by 0.5 percent compared to the same period of 2019.

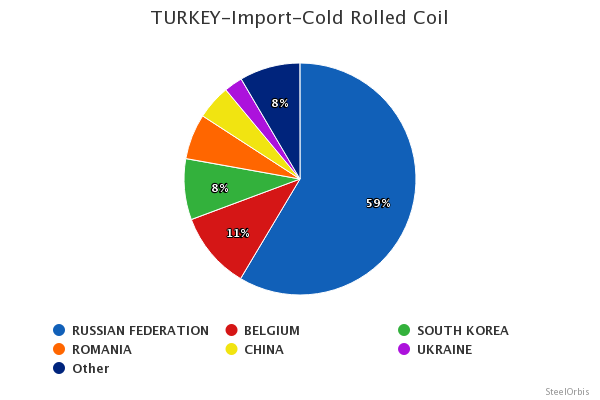

In the first seven months of this year, Russia ranked first among Turkey's CRC import sources, supplying 273,980 mt, up 36.7 percent year on year. Meanwhile, in the given period, Turkey's CRC imports from Belgium totalled 50,366 mt.

Turkey's main CRC import sources in January-July are as follows:

|

Country |

Amount (mt) |

|

|

|

|

|

|

|

January-July 2020 |

January- July 2019 |

Change (%) |

July 2020 |

July 2019 |

Change (%) |

|

Russia |

273,980 |

200,477 |

36.66 |

46,387 |

24,931 |

86.06 |

|

Belgium |

50,366 |

29,272 |

72.06 |

9,794 |

3,152 |

210.72 |

|

South Korea |

39,758 |

6,196 |

- |

273 |

1,010 |

-72.97 |

|

Romania |

29,632 |

40,052 |

-26.02 |

1,328 |

7,069 |

-81.21 |

|

China |

22,477 |

10,471 |

114.66 |

574 |

3,467 |

-83.44 |

|

Ukraine |

12,065 |

11,258 |

7.17 |

1,134 |

1,002 |

13.17 |

|

Netherlands |

11,309 |

13,275 |

-14.81 |

160 |

2,348 |

-93.19 |

|

Italy |

10,737 |

23,357 |

-54.03 |

557 |

6,584 |

-91.54 |

|

Japan |

3,523 |

15,765 |

-77.65 |

- |

- |

- |

|

Sweden |

2,692 |

3,018 |

-10.8 |

508 |

639 |

-20.5 |

Turkey's CRC import sources in January-July can be seen in the graph below: