In the first part of the "SteelOrbis year-end review" regarding the Chinese market, we had shared the main topics of the Chinese steel industry in 2024 and expectations about whether the developments will continue in 2025. In the second part, we focus on the trends of raw material prices and trade flows.

Iron ore supply increases, prices down

The import iron ore market in China has been characterized by a slowdown in demand and a gradual rise in supply, making it a buyer’s market in 2024, and this trend is going to continue in 2025. In the first 11 months of 2024, China’s iron ore imports reached 1.124 billion mt, up 4.3 percent year on year, even though crude steel production in China totaled 929.19 million mt in the given period, declining by 2.7 percent year on year. Two additional trends emerged due to the weaker Chinese market: higher-than-usual iron ore inventories at Chinese ports and lower import volumes of higher grade iron ore due to it being more expensive.

According to SteelHome, iron ore inventories at major Chinese ports were on the rise until the middle of the year, even though traditionally spring is a destocking period. From September 2023 up to February 2024, iron ore stocks at ports were below 120,000 mt, while they moved up to 140,000 mt in March, remaining at high levels of 140,000-150,000 mt since then. “The top four miners [Vale, Rio Tinto, BHP, Fortesque] were increasing production slightly as prices were still not so bad,” a trading source said.

“The supply and delivery of iron ore in the global market will continue to be on the high side in 2025 as most iron ore mines’ production will be stable or inch up. A decline in iron ore prices is the most probable scenario as the steel market will maintain a “high supply, low demand and low profit” pattern, which will negatively affect steel prices, thus weakening the support for iron ore prices,” a top-tier steel mill in China told SteelOrbis.

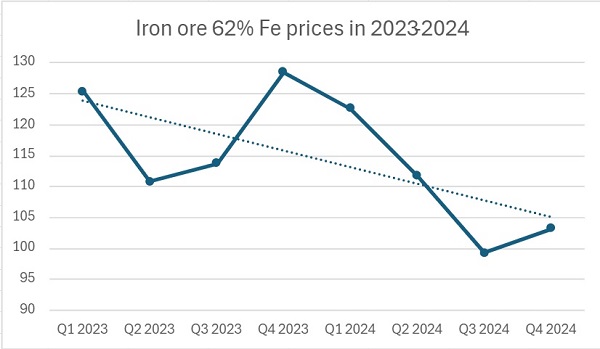

In 2024, the price of iron ore with 62 percent Fe content fell to its lowest level in the third quarter, to $99.32/mt CFR on average. But taking into account the high price base early this year, the average iron ore price in 2024 slipped just by 8.7 percent year on year to $109.24/mt CFR. The average price of iron ore in 2025 is expected to stand at around $95/mt CFR, according to market sources polled by SteelOrbis, while during the year the market may move up first and decline later.

China’s ultra-low emissions program: details and outlook

2024 was referred to by the Ministry of Ecology and Environment of China (MEE) as the first year when major energy users, including steel mills, would have to actively implement measures to cut emissions in line with the required standards.

The integration of the steel industry into the national carbon market will be implemented in two phases. The first phase (2024-2026) will be mainly for the implementation of the evaluation method, based on production and carbon emissions. In the second phase (from 2027), there will be a gradual transition to the baseline method of allocation, with the introduction of an auction mechanism for quotas. This means that some quotas will no longer be allocated free of charge, but will need to be purchased by enterprises through the auction market.

The steel industry is facing the dual challenges of declining economic efficiency and rising inputs for the low-carbon green steel market. Generally, the environmental protection cost (technical transformation and management cost, etc.) for steel enterprises to meet the latest environmental standards is RMB 100-150/mt ($14-21/mt), which increases the cost by more than RMB 1 billion ($0.14 billion) for iron and steel enterprises with an annual production capacity of 10 million mt. For a steel enterprise with an annual capacity of over 10 million mt, assuming a carbon shortfall rate of two percent to three percent, and estimating a carbon price of RMB 100/mt ($14/mt), its annual compliance cost will increase by RMB 20-30 million ($2.8-4.2 million).

For now, there has been no been big impact from the ultra-low emissions program for crude steel production, even though Tangshan has been chosen as the pilot city to fulfil emission targets by the end of 2025. “Producers will lose more if they cut production as other costs will be higher. No one wants to be the first,” a market source commented. In 2025, the major impact on steel mills from this program will be for additional financial expenses for installation of additional (though not major) equipment.

According to a statement from one Chinese mill, “The demand for scrap in China will likely slacken in 2025. Compared to pig iron, scrap has a weaker price advantage, so steelmakers’ scrap consumption will be at a relatively low level. The real estate industry’s weak performance is unlikely to shift in 2025, so I don’t think that there will be another trend in raw material purchases.”

At the same time, coke capacity in China will continue to be characterized by a surplus in 2025, and coke exports are expected to remain firm amid the weak demand in the local market. Japan, South Korea, India, Indonesia and Malaysia are China’s main export destinations. The safeguard policy in India may negatively affect China’s coke exports to India, while export supplies may be diverted to other destinations.