A slight uptick in commercial construction activity has boosted US wide flange beam shipments, but domestic prices still remain neutral for the fourth straight month.

After a relatively flat start to 2011, it seems that end-use activity for the US wide flange beam (WFB) market is starting to show signs of measurable improvement. Service centers in the Midwest and East Coast tell SteelOrbis that they have started to fill out inventories in response to an uptick in orders, although West Coast activity is still relatively sluggish. Nevertheless, the uptrend in purchasing activity--moderate as it is--seemed to start in March and carry over into April. US construction spending data for March has not yet been released, but when it is, it will likely show growth, as other construction indicators already do. According to leading construction industry analyst McGraw-Hill Construction, nonresidential building starts increased by 25 percent in March, despite "particularly depressed" activity in January and February. In particular, office construction starts surged 87 percent, manufacturing plants climbed 42 percent, store construction rose 37 percent, warehouse construction jumped 67 percent, and hotel construction increased 43 percent.

Shipment and inventory data from March seem to confirm these statistics. According to the latest MSCI Metals Activity Report, daily beam shipments from service centers increased from 9,400 nt in February to 9,500 nt in March (monthly shipments improved 17 percent month-on-month, but February also had three fewer business days). Additionally, month-ending inventories increased in March, to 577,000 nt, the highest level seen since April 2009. While this figure likely reflects service centers stocking up for anticipated buying, some worry that it is more indicative of service centers' inability to turn over inventory. Once April data is released in a few weeks, it will be clear which theory is more plausible.

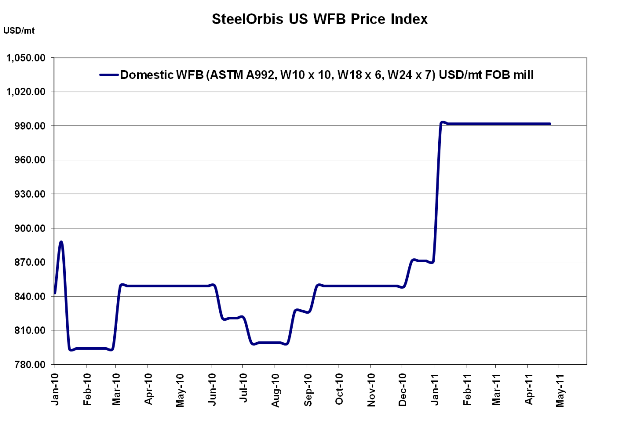

However, despite increasing shipment levels, domestic WFB prices have continued to hover at the same level for four months. Prices are still listed at $45.00 cwt. ($992/mt or $900/nt) ex-mill (for ASTM A992, W10 x 10, W18 x 6, and W24 x 7). According to sources, some distributors are still offering beams for mill asking prices, but mills reportedly have ample stock of a variety of sizes, therefore large tonnage customers have lately veered toward direct mill offerings rather than buying from the distributor. As for price announcements next month, shredded scrap is expected to trend either sideways again, or perhaps slightly down--although a $20/lt decrease would not likely result in a transaction price decrease.

On the import side, most US buyers are still preferring domestic orders for the moment, but sources tell SteelOrbis that certain offshore mills are keeping a "low profile," doing business with only a select group of US customers in order to stay in the market. While beam buyers on each US coast are not exactly seeking out import offers, current Korean offers have been heard at $46.00-$47.00 cwt. ($1,014-$1,036/mt or $920-$940/nt) duty-paid FOB load truck in West Coast ports.

As for imports currently arriving in the US, tonnage levels dropped off in April as predicted in our last report. According to import license data from the US Import Monitoring and Analysis System (SIMA), the US imported 13,849 mt of WFB H-sections and 7,027 mt of I-sections as of April 26, reflecting a decrease of 22 percent and 41 percent, respectively, from March levels. Korea continued to be a top source of H-sections with Luxembourg close behind, with import levels of 5,014 mt and 3,681 mt, respectively. South Africa, which surged ahead to the number two spot in March, was the source of only 943 mt in April, surpassed by Spain and Taiwan, with 1,799 mt each. However, Luxembourg remained the top source of imported I-sections to the US, with 4,269 mt so far in April. Nothing has come in from South Africa for the month, but 1,157 mt came from Canada.