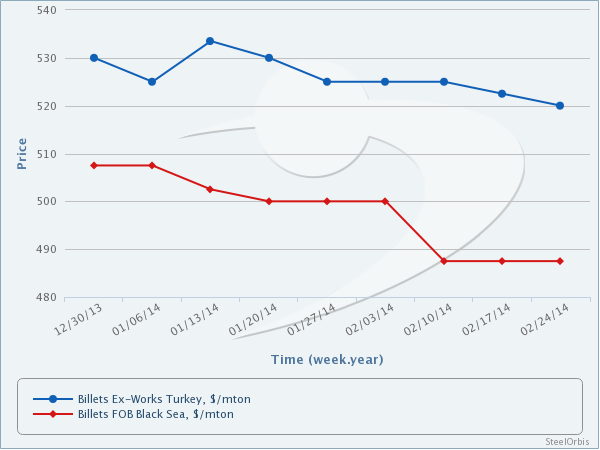

SteelOrbis has been informed by market players that billet prices in the Turkish domestic market are still ranging at $515-525/mt ex-works, indicating no changes since last week. Fluctuations in the US dollar-Turkish lira exchange rate and weak billet demand have resulted in a low trading volume in the market, which has contributed to the sideways movement of billet spot prices over the past week.

CIS billet offers to Turkey have showed signs of strengthening this week, increasing by $5/mt on the higher end to $500-510/mt CFR. However, since many import billet bookings have been concluded in Turkey over the past two weeks in the range of $500-505/mt CFR, demand for import billet is on the poor side and buyers are not in a rush to conclude new purchases. Meanwhile, there will be no downward pressure on new CIS billet offers since CIS mills have already completed most of their sales for March production materials.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.