The domestic US plate market continues to undergo significant price decreases, while traders are just waiting for the opportunity to at least make some serious offers again.

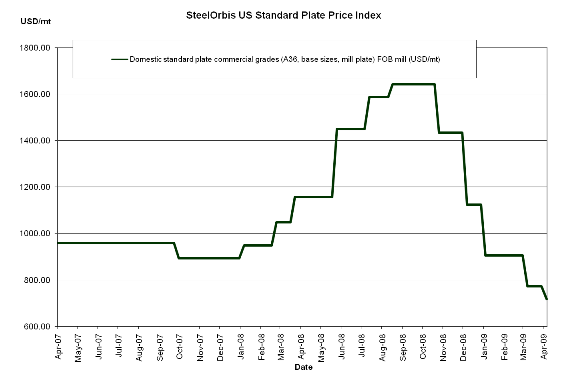

Domestic US plate prices have already declined by about $1.00 cwt. ($22 /mt or $20 /nt) since our report last month, and are expected to decline about another $1.50 cwt. ($33 /mt or $30 /nt) this week, resulting in a new range of approximately $31.50 cwt. to $33.50 cwt. ($694 /mt to $739 /mt or $630 /nt to $670 /nt) FOB mill for commercial grades (A36, base sizes, mill plate). While $2.50 cwt. ($55 /mt or $50 /nt) is a significant monthly decrease, it pales in comparison to the $6.00 cwt. ($132 /mt or $120 /nt) decrease over the previous month's span. Nonetheless, domestic mills continue to demonstrate their aggressiveness by negotiating discounts depending on order specifics and size.

Overall domestic demand remains weak, which, combined with the soft flats market, is expected to continue to contribute to a slightly downward trend over the next month. However, one bright spot for the domestic plate market is that commercial shipbuilding and ship repairing has apparently begun to exhibit a slight up-tick, which led one US service center executive to share his opinion with SteelOrbis that the plate market could stabilize by as early as the end of June. Regardless, as long as demand remains as weak as it has been, prices will not be able to sustain any sort of stability.

On the import side, plate offers are failing to generate much interest, despite the fact that most import offers can now be found in the mid-$20s cwt. Traders have too many obstacles stacked against them, especially during this economy. Even if lead times and aggressive US domestic mills weren't enough to deter new potential import deals, buyers have the ability to pick up a variety of specific sizes and increments of plate tonnage from available inventory on the ground at most US ports from canceled orders, at a premium discount.

License data from the US Import Administration demonstrates that import tonnage of cut-to-length plates has decreased drastically from January to February, to March, at 102,194 mt, 65,313 mt and 35,255 mt respectively. March 2009 import plate tonnage levels are an approximately 68 percent less than the 109,505 mt imported in March 2008.