Flat steel producers in Europe and the Middle East are facing a tangible shortage of re-rolled products. The war in Ukraine has not only led to a sharp rise in raw material prices around the world but has also affected the redistribution of commodity flows. Consumers are interested in slabs and hot rolled coils (HRC) from Asia, primarily from China and Southeast Asian countries, where they can find good volumes of available re-rolled material.

At the same time, Chinese suppliers remain interested in hot rolled coil sales to the Middle East and in slab sales to Europe since the achievable prices there are higher than in nearby markets. Chinese mills are faced with a decrease in demand for steel products in their domestic market, given the new wave of Covid-19 and the lockdowns imposed in Chinese cities. Growth in demand from European and Middle Eastern markets makes it possible to redirect some volumes to these markets. According to SteelOrbis’ estimates, at the end of March the profit margin for Chinese hot-rolled coil amounted to $80-90/mt (CIF basis) in the Vietnamese market, while reaching $120-170/mt in Turkey. However, European buyers are not interested in ex-China HRC, given AD and CVD rates within the range of 18.1-35.9 percent. But the situation may change shortly. With the current duties, the profit margin for Chinese hot-rolled coil in the European market already varies from $10/mt to $150/mt, depending on the plant.

The Turkish market seems to be dominated by ex-China HRC at present. According to SteelOrbis’ sources, China has been selling huge flat steel volumes to Turkey since the end of February, but also decent tonnages have recently been traded from China to the Middle East and Africa. Sellers of ex-China HRC have succeeded in trading up to 200,000 mt in total to the MENA region. Order bookings for Chinese hot-rolled coils to Turkey, as well as for some CR full hard coils, have already approached 700,000 mt in March, according to some sources, with most of the orders either for April or May shipment.

At the same time, Chinese steel producers currently have a high margin of profitability. Chinese companies producing BOF steel products are less dependent on scrap price fluctuations, unlike the same producers from Turkey. According to the results from the past month, imported scrap price in Turkey increased by $120-130/t (+27% compared to February), while scrap in the Chinese domestic market decreased by $30/mt (-6%). The decline in demand as part of the reduction in steel production allowed Chinese producers to reduce their domestic steel scrap purchase prices.

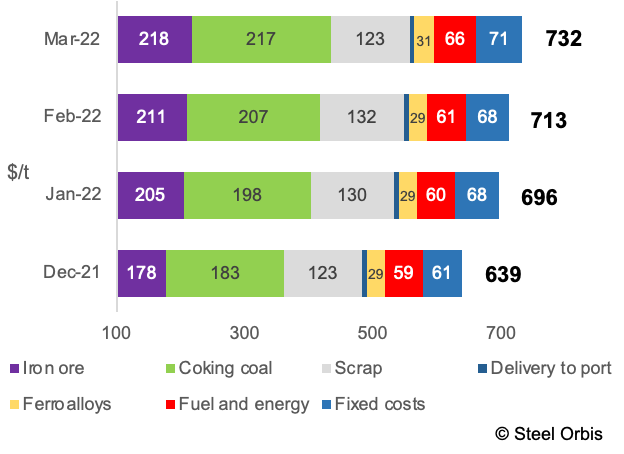

Iron ore, the main raw material for BOF steel production, has risen in price by only $10/mt over the past month (+6% compared to February). The war in Ukraine has had a much lower impact on the Chinese iron ore market than on the Turkish scrap market. Australian ore, as the global benchmark, is mainly dependent on the demand level in China.

In March, the gap between premium hard coking coal prices FOB Australia benchmark and the CFR China price for the similar grade touched $200/mt in the middle of the month, when the ex-Australia FOB price surged to $670/mt FOB. Even despite some retreat in FOB prices by the end of March, this gap is still big - ex-Australia prices are $60-100/mt higher as the tradable level for Chinese customers is hardly above $440/mt CFR for premium hard coking coal. The Chinese domestic coking coal market has softened recently as Tangshan has entered a temporary lockdown to control the surging number of Covid-19 cases.

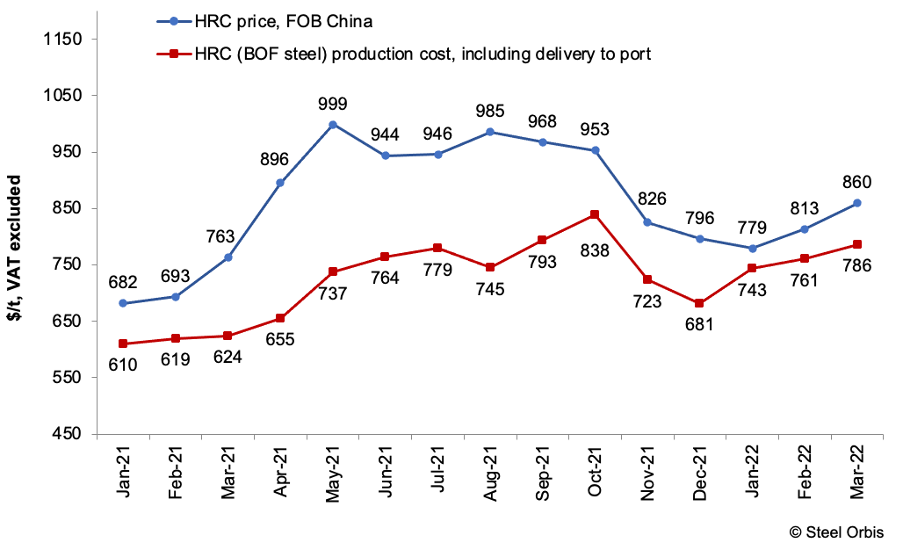

As a result, in March BOF steel raw material costs in China rose by $15/mt to $630/mt, SteelOrbis estimates. The Chinese hot-rolled coil (HRC) production cost from BOF steel in March increased by $25/mt to $780/mt on ex-works basis ($755/mt in February). Over the same period, average monthly HRC export prices from China rose by almost $50/mt to $860/mt FOB. Higher rates of growth for steel product prices than for raw material prices were reflected by a 40 percent rise in the Chinese HRC margin over the month. In March, the profitability of Chinese HRC exporters increased by $20/mt and amounted to about $70-75/mt, SteelOrbis estimates.

Chinese HRC (BOF steel) export margin, FOB basis

Apart from the increased exports of HRC to Turkey and the MENA region, China started slab exports due to even higher profitability, mainly to Europe. EU mills have been active in Chinese slab purchases, since they need to replace missing volumes, mainly ex-Ukraine tonnages. FOB deal prices for Chinese slabs ranged mainly at $840-860/mt FOB in March, with most deals at the higher end of the range. Though the freight from China to Europe is above $150/mt, prices have been competitive and in total Chinese mills managed to sell at least 300,000 mt of slabs to Europe in March. Despite very high freight costs, ex-China slab prices are competitive in Europe, while negotiations for ex-Russia slabs have not been heard, even despite the absence of an official ban on semis imports to Europe from the country, while prices for slabs from other Asian suppliers like Indonesia and India were higher.

The Chinese slab production cost from BOF steel in March increased by $20/mt to $725/mt on ex-works basis ($705/mt in February).

Chinese slab (BOF steel) production cost, including delivery to ports

The slab margin per ton for Chinese producers in March amounted to about $110-120/mt, which is significantly higher than the profit margin for hot-rolled coil. Due to strong demand, the slab price in China is now almost equal to the HRC price. It is now more profitable for Chinese producers to sell slab, which some plants do. But given the rather low demand in the domestic market, we should expect an increase in exports from China in the coming months for all flat product positions. This is especially true for the European and Middle Eastern markets due to the tangible supply shortage.