In the CIS flat steel market, the price increases which have continued since December last year are also seen to prevail in CIS flat steelmakers' offers for their February production. Raw material price increases and a certain revival of demand due to reduced inventories have pushed up flat steel offers in the CIS. Producers in the CIS have started to return from the New Year holiday as of today and the steel markets are now focused on the new offers from CIS flat steel producers. The first CIS flat steel export offers of the New Year have come from Russian steelmaker Severstal.

SteelOrbis has learned that Severstal's hot rolled coil (HRC) offers for its February production to the export markets have shown a price increase of $60/mt as compared to last month and are now standing at the base price level of $650/mt FOB St. Petersburg. Meanwhile, Severstal's export offers for its February production hot rolled plate (HRP) offers stand at $730/mt FOB St. Petersburg - up $40/mt, its CRC export offers stand at the base price level of $760/mt - up $30/mt, and the producer's HDG coil export offers stand at $860/mt, rising by $30/mt, all compared to last month. On the other hand, Severstal's HRC export offers to Turkey were at $720/mt FOB, rising by $70/mt, while its CRC offers to Turkey were at $830/mt, up $20/mt, both as compared to last month's offer levels. However, today, January 10, Severstal said that its central office will revise its flat steel export offers to Turkey in an upward direction, and thus its previously announced offers for Turkey are no longer available.

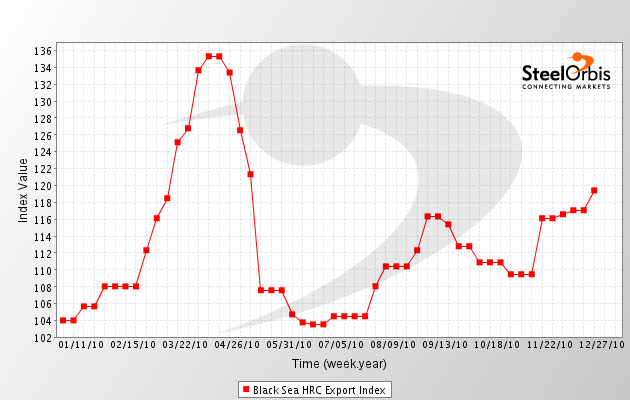

This week, other CIS flat steelmakers are also expected to announce their flat steel offers. Market sources indicate that they expect a price increase of $40-50/mt over the HRC offers for January production which stood at $610-640/mt FOB Black Sea. In the Orbis Steel INDEX this week, the ‘Black Sea HRC Export Index' has increased by 2.01 percent as compared to last week. It is anticipated that the index will register a further increase, once producers announce their offers this week.