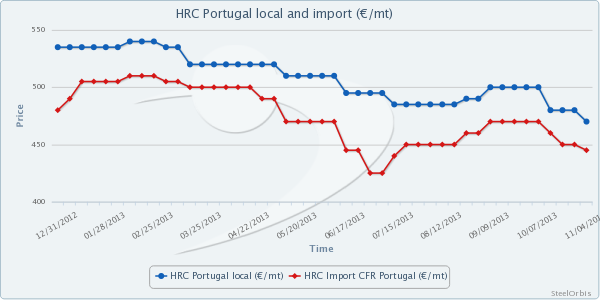

SteelOrbis has learned from market sources that prices in the Portugese flat steel market have softened by €20-25/mt ($27-34/mt) since last month. It is observed that purchases for 2013 have been completed in the market, while market players state that downward pressures on prices have eased and this is expected to prevent further price decreases. As no support currently exists for any price increase, prices are expected to trend sideways in the coming period. Market sources say that demand, which has been weak for a long time, may improve in the coming period though a big improvement is not expected.

Hot dip galvanized (HDG) base prices in the Portugese domestic market for November deliveries are standing at €525/mt ($709/mt) ex-works, while local prices for hot rolled sheets (HRS) are at €515-520/mt ($695-702/mt) ex-warehouse for prompt shipments.

However, ex-Spain HDG offers to Portugal for December shipments are standing at €535/mt ($722/mt) CIF, while hot rolled coil (HRC) offers for December shipments are at €445/mt ($601/mt) CIF . Meanwhile, offers from Italy to Portugal for HRC and HDG are standing at €450/mt ($607/mt) CIF and €500/mt ($675/mt) CIF respectively, both for January shipments. All the prices exclude VAT.

€1 = $1.35

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.