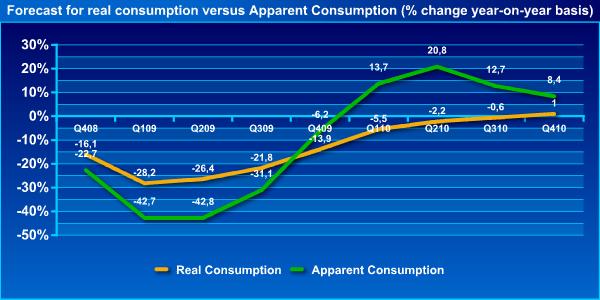

According to the real and apparent consumption figures that were revised downward by EUROFER (European Confederation of Iron and Steel Industries) in June, it is expected that destocking process in the European steel markets is nearing its conclusion; however, it will not finally come to an end until the start of the last quarter of 2009.

In northern Europe, HRC base prices are at €360-420/mt ex-works, while CRC base prices are at €430-480/mt ex-works. In eastern European countries, i.e. Poland, Slovakia and Hungary, flats prices are standing at the low end of the price ranges in question, while in western European countries, i.e. UK and Germany, prices are at the high end.

Slight increases in demand have had some influence in the price hikes seen in the flats markets and overall steel markets in northern Europe within the last two months; however, supply levels have constituted the main factor. The tightening of production - the average capacity utilization rate in continental Europe is around 50 percent - has accelerated the destocking process and has caused supply and demand to reach equilibrium. On the one hand, real demand has been increasing slowly, i.e. end-users have been entering the market with small and gradual steps; however, on the other hand, there are concerns that on the supply side the integrated mills may rapidly and overhastily raise their capacity utilization rates. Such concerns are not idle, considering that the integrated mills will not be able to maintain their current low outputs in the long term due to financial pressure.

The annual global steel production capacity is 1.7 billion mt. However, if production throughout 2009 continues as in the first five months, it is expected that actual total global steel output for the year will amount to 1.1 billion mt, resulting in overcapacity of 600 million mt worldwide.