Part 1. Guess who's holding the trump cards?

(Note: Zugzwang is a condition in which a chess player has a solid position; but, once he or she makes the next move, the consequence is a lost position.)

As WSD sees it, the Chinese economy and its steel industry are in zugzwang because, almost no matter what's their next move, the outcome is a losing position. For example:

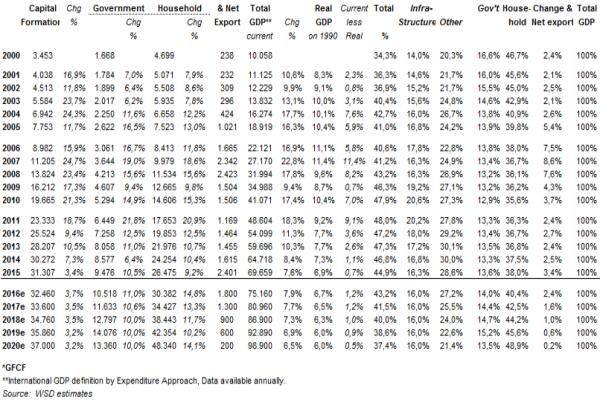

- China is near its upper limit in promoting fixed asset investment (FAI) as a share of GDP. Already, adjusted FAI is close to 45% of GDP. It appears that high returning projects are less available due to overbuilding and municipalities' debt is rising substantially as the consequence of the massive spending.

- The country is suffering from massive capital outflow because there's loss of confidence on the country's growth rate, the lessened competitiveness of its manufacturing sector, and worries about anti-Chinese trade measures in other countries, a weakening RMB and the increased attractiveness of USA treasury securities due to rising interest rates in the United States. China's reserves tied to foreign exchange factors has now only about $3.0 trillion versus $3.9 trillion in June 2014.

- A weakened Chinese RMB/U.S. dollar will lead to worries that inflation in the country is about to accelerate as China needs to import raw materials from overseas markets. As more information becomes available about the inner workings of the Chinese economy, such as the 20% overstatement of GDP by Liaoning Province several years ago, China's "country risk factor" will continue to rise in the eyes of both its domestic and foreign investors.

- The country's housing investment sector is in the process of turning down sharply - as it also did several years ago - due to the recent rapid run-up in prices - in effect, a Chinese housing price bubble. As a share of adjusted fixed asset investment, housing investment accounts for about 23% of the total; manufacturing about 32%; and infrastructure spending about 25%.

- The country's air and water pollution problems accelerate policymakers' desire to lessen the emphasis on heavy industry growth in China - which has been the largest source of the economic growth, by far, in the past decade.

- President Trump seems likely to impose sizable tariffs on a number of China's manufactured goods. In general, at the present time, it seems correct to say that China is the world's greatest beneficiary of mercantilistic practices by its government's policymakers; and, the USA is probably the biggest loser. This situation seems about to end.

- Regarding China's steel industry has huge excess capacity. For example, 123 blast furnaces have been built since 2012 with 163 million tonnes of capacity. Moreover, Chinese steel demand seems almost certain to decline 10-15% in the next half-decade as: a) GDP grows more slowly, which means that services account for a greater share of GDP growth; and b) steel-intensive FAI declines as a share of GDP as only moderate steel-intensive household spending rises as a share of GDP. To make matters even worse for the Chinese steel mills, steel product exports of about 110-115 million tonnes per year are far from sustainable because of the avalanche of trade suits filed against the Chinese mills since 2015.

- Regarding mercantilism, it is a broad-based version of protectionism designed to promote the growth of selected manufactured products via the practice of imposing high import tariffs or quotas on these products. In effect, mercantilism can be practiced only when a country's policymakers have the power to place at a disadvantage its key trading partners.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2017 by World Steel Dynamics Inc. all rights reserved