The increased likelihood of “higher for longer” interest rates for the Developed Economies (and, by proxy, ex-China Developing ones) has been the most important factor behind the current “global economic chill.” Many groups – especially in the real estate sector and increasingly on the consumer side – are beginning to feel the impact of higher interest rates and, as a consequence, are paring back their purchases of durable goods and reducing investment, respectively. In fact, an investment recession, that includes inventory reductions, is probably already in effect because so many industrial companies are delaying some portion of their capital spending programs pending more clarity about the outlook.

Another reason for the reduced economic activity, WSD thinks, is the reversal of undetected excesses that were created during the post-Covid economic recovery from late-2020 to early 2022 and prolonged by the Russia/Ukraine war into early-2023. These excesses, theoretically speaking, are now being reversed by the Invisible Hand – i.e., price allocates resource. Here is a possible example. Too much material may have been accumulated in manufacturers’ work-in-process – which is now being cut back (and, for those in the steel marketplace, feels like a steel buyers’ inventory reduction) as producers and buyers over-bought and over-produced during the seemingly perpetual shortages of 2021-2022. From the viewpoint of steel inventories, the onset of the Russia/Ukraine war in early-2022 likely created a second wave of excess as buyers, panicked about another wave of supply disruptions, purchased large volumes of steel products on the world market.

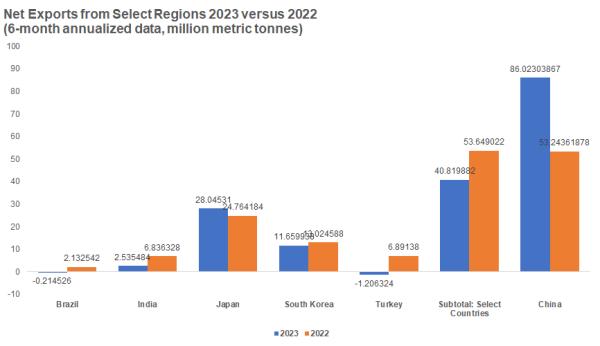

Early evidence of these phenomena is becoming visible via preliminary apparent steel demand calculations for select countries outside of China. Based on partial-year 2023 steel import/export data and juxtaposed with reported steel production, WSD estimates that ASC in a number of major Developed and Developing countries ex-China is down about 3.5%.

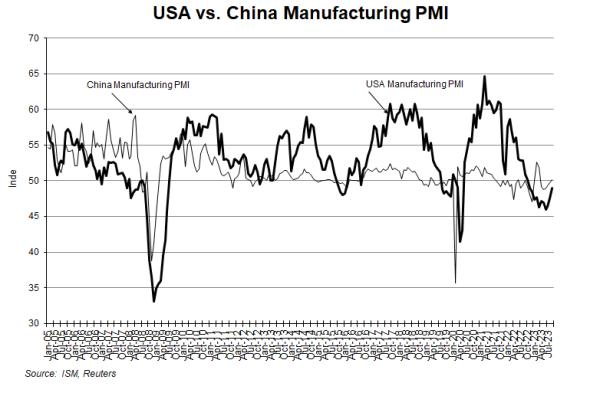

Purchasing manager sentiment – the PMI – has turned negative in the USA, Japan and Europe. And, in China, the steel industry’s PMI has fallen to just below 50.0, indicating that activity is contracting. Below is a comparison chart between the USA and China manufacturing PMI.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non -public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2023 by World Steel Dynamics Inc. all rights reserved