Recent research has shown that the global steel industry's greenhouse gas (GHG) footprint was around 4.43 gigatonnes of C02equivalent (GtC02e) in 2023, which was 8.2 percent of total global GHG emissions of around 53.8 GtC02e in that year. The steel industry's share in total global C02 emissions, excluding other GHGs, was higher at 10.7 percent.

In 2025, global steel industry emissions actually fell marginally by 0.4 percent year on year. But this has been due to decrease in production because of weak economic sentiments and slump in demand rather than through low-carbon technology deployment.

Cross country steel industry emissions data recently published by Global Energy Monitor (GEM) for the year 2023 (the latest data available) show how unequal access to critical raw materials such as ferrous scrap and low carbon fuels shape the emissions trajectory of different countries. For example, the US and Turkiye have far lower average emissions intensity of steel production (around 1.2 tCO2e/tcs) compared with China and India (around 2.6-2.5 tCO2e/tcs).

This is because China and India are largely dependent on coal for steel production due to unavailability of scrap in required volumes and lower access to comparatively cleaner natural gas unlike the US.

Blast furnace emissions

So, with the Chinese steel industry contributing 55-60 percent of global production, and with India being the second largest producer increasing its share at the fastest pace among all countries, the focus of steel decarbonisation naturally shifts to Asia and, of course, the blast furnace which comprises around 90 percent of Chinese steel production and roughly 45 percent of India's output.

Although India's coal dependence doesn't end with the blast furnace, with coal-based DRI forming a significant chunk of total iron production, the sheer scale of announced investments in BF-BOF steel production reinforces the focus on the BF as the central focus of decarbonisation efforts in India and globally.

For perspective, BF-BOF accounts for over 88 percent of steel industry emissions, as per GEM data. "(The BF-BOF route) accounted for nearly 3.9 GtCO2e, while electric arc furnace (EAF) route emitted around 0.53 GtCO2e" globally in 2023, states GEM's latest Steel Climate Impact 2025 report.

"Fuel-related emissions remain the main driver across all routes, especially in BF-BOF steelmaking, reflecting the industry's heavy reliance on coal. Emissions are also highly concentrated geographically: China alone produced about 60 percent of global steel GHG emissions, followed by India, Japan, Russia, and South Korea. These five countries alone account for around 80 percent of global steel GHG emissions," the report observes.

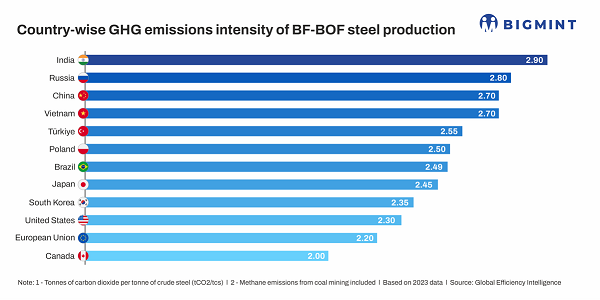

Disparity in BF-based emissions

Unequal access to scrap, low-carbon electricity and fuel sources, and the resultant dependence on coal, explain the wide spread in BF-based emissions across countries (see figure above). India shows the highest GHG intensity for BF-BOF steelmaking at 2.9 tCO2e/tcs, followed closely by Russia at 2.8 tCO2e/tcs and China and Vietnam at around 2.7 tCO2e/tcs.

"In India," the report notes, "many BF-BOF plants remain older and less efficient, although it should be noted that some of Indias newest facilities are among the most advanced globally." While this assuages concerns related to the energy and emissions performance of the new BF capacity coming onstream, the task of cleaning up a lot of existing production remains and this happens to be the most pressing.

According to sources in the domestic steel industry, the best available technologies (BATs) in BF-based production have the potential to reduce existing emissions by 15-20 percent. Strategies such as BF top gas recycling, coke dry quenching, pilots centering on injection of low-carbon fuels and gases into the BF are already underway in India not to mention R&D on hydrogen and biofuel use in the BF. Raising scrap charge in the BOF is also an option that steelmakers are already adopting.

For deeper decarbonisation of the BF, the government is chalking out a CO2 storage and utilisation plan and the leading companies are investing in CCUS in specific set-ups. Methane emissions from coking coal mining and India's heavy reliance on imported coal, especially Russian and US coals with high specific methane emissions, exposes the domestic steel industry to imported emissions.

This lack of control over supply chain emissions is also a major challenge for the Indian industry.

Source: BigMint