US domestic spot prices for hollow structural sections (HSS) have fluctuated since our last report two weeks ago, as while some mills are already implementing the January 10-announced $3.50 cwt. ($77/mt or $70/nt) increase on HSS, others have given buyers a few weeks to place last minute orders. By the beginning of February, however, all tubing mills will be adamant about pushing the latest increase through, and with an additional increase announcement for approximately $3.00 cwt. ($66/mt or $60/nt) expected by month's end to match the January-6 announced $60/nt increase on hot rolled coil (HRC), mills should have no problem collecting the January 10-announced HSS price hike.

Also helping to push increase announcements through are upticks in demand levels in certain sectors. Buying activity remains relatively slow, but steady nonetheless, with agricultural manufacturing still plugging along in the Midwest. And with the anticipation that non-residential construction will carry the HSS market during the sluggish economic recovery, distributors are cautiously optimistic that although spot prices will likely begin to edge down after Q1, they will not plummet as many had predicted in December when spot prices began their rapid uptrend.

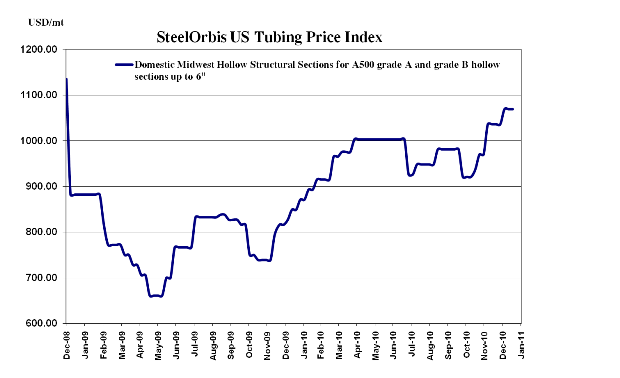

HSS spot prices remain in the $47.00-$50.00 cwt. ($1,036-$1,102/mt or $940-$1,000/nt) ex-Midwest mill range for the majority of large tonnage buyers, while smaller distributors are already paying $50.00-$52.00 cwt. ($1,102-$1,146/mt or $1,000-$1,040/nt ) ex-Midwest mill for new orders. On the West Coast, spot prices are now approximately $52.00-$53.00 cwt. ($1,146-$1,168/mt or $1,040-$1,060/nt) ex-mill, a $2.00 cwt. ($44/mt or $40/nt) increase over spot prices two weeks ago.

Despite steady order activity and rapidly rising US prices, interest in offshore offers remains tepid. Turkish HSS offers to the US have increased $1.00 cwt. ($22/mt or $20/nt) on the low end over the past two weeks, putting current sales prices at $43.00-$44.00 cwt. ($948-$970/mt or $860-$880/nt) duty-paid FOB loaded truck in US Gulf ports. And while those offers are expected to rise in the coming weeks, they will still be well below US prices once recently announced increases take effect, which may trigger eager buying activity if end-use demand levels in the US don't taper off.