The downtrend of iron ore prices which had been continuing for weeks accelerated a little at the beginning of this week, with prices dropping below $100/mt for the first time in a long time. It had been expected that decreasing iron ore prices would exert downward pressure on pig iron prices, but lately pig iron prices have been showing some greater independence from the changes in prices of scrap and iron ore, while iron ore prices are also not expected to decline below current levels. Accordingly, pig iron prices may not indicate the previously anticipated decreases. The latest HMSI/II 80:20 scrap transaction was at $370-375/mt CFR Turkey, while the latest pig iron deal was concluded at $405-410/mt CFR Turkey, with the gap between scrap and pig iron prices having widened over the past year. This gap complicates bargaining between pig iron suppliers and steel producers, while pig iron producers have been trying to maintain high prices due to elevated raw material and production costs.

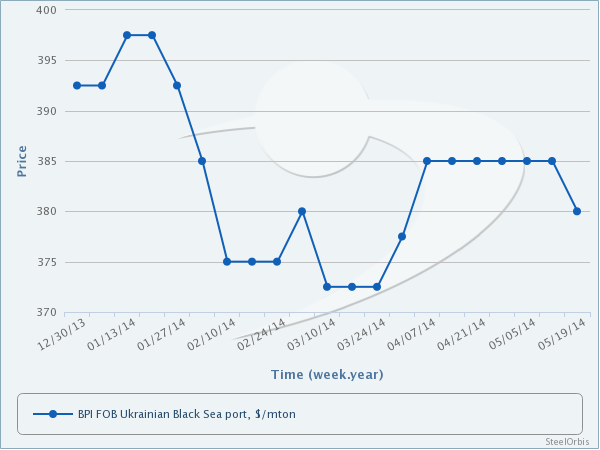

According to market sources, ex-Ukraine pig iron offers have decreased slightly compared to last few weeks to $375-385/mt FOB amid tighter profit margins, while new transactions have been concluded at these price levels. Demand for pig iron from Europe and especially from the Italian foundry sector is satisfactory. The expectations that iron ore prices will not fall below current levels support new predictions that pig iron prices will not move down any further.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.