Earlier this week, SteelOrbis reported that Turkish mills were cautious in terms of scrap purchases and were continuing to monitor international developments. Negative sentiments were building up rapidly in Turkey’s import scrap market.

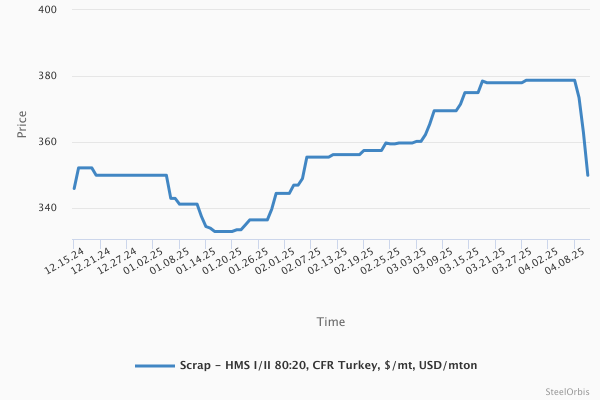

On April 9, an ex-US scrap deal surfaced in the Turkish market with the HMS I/II 80:20 scrap declining to $366/mt CFR, showing that the negative pressure exerted by Turkish mills was successful. Despite rumors on April 9 of an ex-Netherlands booking at $365/mt CFR for HMS I/II 80:20 scrap, which were denied later in the day, the price drop in Turkey’s import scrap market was sharper than anticipated, with prices regressing to the levels recorded earlier in March, losing all the ground gained over the previous month.

However, the Turkish scrap market has fallen sharply today, April 11, with an ex-St. Petersburg deal done by an Izmir-based producer, with the HMS I/II 80:20 scrap price standing at $350/mt CFR. While Russian origin scrap is usually $5/mt cheaper than other Baltic material, most market sources report this is not the end of the price decline in the market.

European suppliers had been collecting scrap in the range of €280-290/mt DAP, with rare bids from exporters at €275/mt DAP. SteelOrbis has learned that as of today, April 11, some scrap exporters have cut their collection quotations to €270/mt DAP. Despite the sharp fall observed over the past week (earlier last week, collection prices were at €310/mt DAP), the euro-dollar exchange rate at €1.14 to the dollar is still an obstacle for European sellers. “Mathematically, European scrap suppliers cannot cut prices below $360/mt CFR, but I think we have passed that level anyway. There are around 15-16 offers from the EU and the US in the market, maybe slightly higher with the silent ones. We hear that European yards are carrying high tonnages of inventory, also exerting pressure on prices. We [Turkish mills] have no appetite to buy scrap due to the almost halted steel trade inland as well as the cheaper billet offers,” a source at a Turkish mill said today. A European scrap supplier commented “I was expecting a fall, but not a sharp one like this. I do not think the Europeans can accept such prices [meaning lower than $350/mt CFR Turkey] with the current euro-dollar rate.” Another European scrap seller disagreed, saying, “I think we will be forced to accept losses in this round. The sentiment, globally, is very negative.” A third scrap exporter said $340/mt CFR for European scrap will be seen in the end, adding, “There is nothing supporting the market. Steel trade is not recovering. Things are changing daily on the international scene, everyone is cautious. Turkish mills are failing to sell products. Before they see some sales, they are unwilling to buy scrap even at the lower levels recorded in each deal.” A source at one Turkish producer stated, “I do not think this is merely the impact of the US tariffs or the trade war. Turkey’s own dynamics also do not support local traders much. Late 2024, we were saying the first half of this year could be hard. In the end, we have ended up where we are and we will now have to look to the second half of the year.”

With this week’s declines, the Turkish scrap market has lost all the increases recorded since early February. On February 2, the average HMS I/II 80:20 scrap price in Turkey was at $349/mt CFR, with the price subsequently moving up to $379/mt CFR on March 29, while today, April 11, the price stands at $350/mt CFR, all average prices. Having said that, it is important to point out that 2025 started with the average deep sea HMS I/II 80:20 scrap price standing at $350/mt CFR, with the bottom level of prices at $333/mt CFR recorded on January 16.

Under the current conditions, the deep sea benchmark HMS I/II 80:20 scrap prices in CFR terms have decreased by 7.59 percent week on week. The prices are now 5.28 percent lower month on month in the deep sea segment, with prices being in the range of $345-355/mt CFR.

US ferrous scrap prices for April delivery settled $20-40/gt ($20-41/mt) less this week during the April buy-cycle negotiations on the heels of a potential peak in the price of finished steel and considerable market jitters over the potential effects of tariffs, market insiders told SteelOrbis. Recent first quarter gains in finished steel pricing, they said, were encouraging the entry of more imports into the US, and so mills were increasingly reluctant to continue to raise price offers.

And, following on previous reports of March scrap supply cancellations from mills, insiders said lower prices were “pretty much a given” as it appeared mills’ appetite for fresh scrap inventory was limited.

“This is the first up market we’ve seen in a year,” remarked one Midwest scrap broker, adding, “It’s quite disappointing to give it all back already.”

Since January 1, SteelOrbis data show Midwest shredded scrap prices had increased from on average $378/mt ($342/nt) to a high of $399.50/mt ($362/nt) at the end of March, a 5.7 percent rise. On April 1, 2024, Midwest shredded prices averaged $406.50/mt ($369/nt), up from the recent March scrap settled price of $439.50/mt ($399/nt) seen on April 10.

Insiders said late in the April supply negotiations that tariff-related actions by US President Trump were dominating the news, increasing the uncertainty among steel market players.

“There still seems to be a lot of uncertainty out there, so bigger drops could be in store for April scrap,” another Midwest scrap insider said prior to the lower monthly settlements.

The local Polish scrap market has showed signs of a decline at the beginning of price negotiations. In a scenario of declining exports, unimpressive finished steel demand and an excess availability of higher quality scrap, scrap prices are beginning to wobble from the peaks registered in previous months. A number of local producers are reluctant to make a decision, waiting to see a move from other European countries, particularly Germany. There is talk about possible declines in the range of €3-10/mt for all scrap grades, but no deals have been confirmed yet.

Collection prices for export yards have dropped to €295/mt DAP for HMS I/II 80:20, which marks a €15/mt decline compared to the last levels reported.

The local German scrap market has showed different trends this week, while monthly scrap purchase negotiations by mills are still ongoing. There are no major changes in the market fundamentals, but low water levels in the Rhine are making scrap deliveries more difficult and transportation costs have increased. According to one source, inland freight costs have risen from the previous €11-12/mt to €30/mt.

One major German steel producer has cut its scrap purchase price by €30/mt. Other areas of the country, however, have seen stable (in the south), or higher prices (in the east), rising by €8-12/mt. As for exports, collection prices for export yards have declined sharply, shifting from last week’s €310/mt for HMS I/II 80:20 to around €280-285/mt DAP this week.

The mood in the local Italian scrap market [link] has changed this week. Due to the continuous changes in Trump’s tariffs, uncertainty has increased among market players, who now believe that declines are possible in the coming days. Nonetheless, deals have been few, and scrap offers and scrap demand have been substantially balanced this week.

Italian steel producers mainly prefer scrap imports rather than local purchases, and deals from Germany and France have already marked some declines by €5/mt. All this said, local scrap prices in Italy have remained substantially stable, but it is likely that we will see some declines by at least €5/mt starting from next week.

Japan’s Kanto scrap export tender was closed with a price decrease on April 9. Although the Japanese yen price indicated a drop, the dollar-based price remained relatively stable based on the yen-dollar exchange rate.

In the Kanto export tender, the highest bid was at JPY 43,288/mt FAS, JPY 938/mt lower than last month. The dollar-based price increased very slightly from $297/mt to $298/mt FAS, taking the exchange rate into account. The FAS price translates to JPY 44,288/mt FOB or $306/mt FOB, up $2/mt on US dollar basis.

After increasing its domestic scrap purchase prices on April 8 by JPY 1,000-1,500/mt, again for its Tahara and Nagoya plants, the leading Japanese EAF-based steel producer Tokyo Steel reduced its domestic scrap purchase prices for the Kyushu region, announcing a drop of JPY 500/mt on April 9.

Tokyo Steel’s general range for H2 grade scrap price stands at JPY 40,500-43,000/mt ($278-295/mt) depending on the mill, with its shindachi scrap prices at JPY 41,500-45,000/mt ($287-311/mt), both delivered.

Taiwan’s import scrap prices have decreased by another $5/mt in the past week, in line with the sharp downward movement observed in the international scrap market. This week, domestic rebar sales in Taiwan have remained quiet as US President Trump’s tariff policy is changing too rapidly, market sources report.

Offers for ex-US HMS I/II (80:20) scrap in containers to Taiwan have moved down to $308-317/mt. Actual deal prices have also moved down, to $305-307/mt CFR.

Offers shared for Japanese H1/2 (50:50) scrap bulk to Taiwan have remained limited for the third week in a row, with the offer prices at around $325-330/mt CFR, down by $5/mt on the lower end.

Vietnam’s import scrap market has moved down by another $5/mt over the past week. As the international scrap market is declining at a fast pace, Asia has followed suit. The lack of steel demand and also the lack of interest shown in import scrap amid ongoing uncertainties surrounding global trade are forcing Vietnamese producers to be cautious.

Over the past week, offers for Japanese H2 scrap to Vietnam have moved down another $5/mt on the upper end to $330-335/mt CFR. Bids from Vietnamese buyers are $3-5/mt lower than the offers.

Ex-US bulk HMS I/II 80:20 scrap offers to Vietnam have moved down by $5/mt over the past week to $360-365/mt CFR.

This week, Pakistan’s import scrap market has remained largely stagnant, with sluggish domestic rebar demand and no clear signs of a price rebound. Buyers have continued to adopt a cautious, wait-and-see stance amid weak trading activity. Offers for ex-EU/UK shredded scrap in containers have edged down to $390–395/mt CFR, with at least 4,000 mt in total of scrap reported to have been bought at the abovementioned levels this week. Meanwhile, according to sources, most market insiders expect new deal prices to reach $380-385/mt CFR levels in the short run. Meanwhile, ex-UAE shredded scrap offers have remained stable at $400–403/mt CFR. Market participants are cautiously optimistic that sentiments may improve after the upcoming federal budget announcement expected in May or June.

Bangladesh’s scrap market is seeing a gradual improvement as rebar demand picks up in key consumption hubs, though industry players remain cautious, expecting only a modest post-Eid recovery. Scrap prices are showing signs of a mild rebound, with shredded scrap from the EU/UK offered at $390–395/mt CFR and ex-Australia offers at $385–390/mt CFR. PNS scrap from Hong Kong has been maintained at $390–395/mt CFR. However, bulk segment activity remains weak, with ex-US HMS priced at around $380/mt CFR. Market sentiment is also being weighed down by uncertainty over Hong Kong Convention (HKC) compliance deadlines, which could impact shipbreaking scrap supply. Additionally, with imported scrap inflow slowing, Dhaka-based buyers are relying more on domestic sources, while larger mills remain cautious in their purchases.