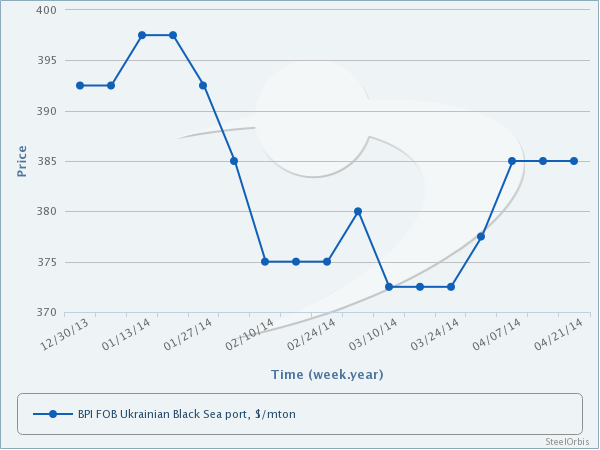

CIS pig iron suppliers had pushed their offers up slightly in the first half of April. Meanwhile, besides the downtrend in both iron ore and scrap prices, the lack of pig iron demand in the target markets of CIS suppliers had increased expectations for limited upticks in pig iron prices. However, the latest transaction prices indicated an increase of $5-10/mt as compared to buying prices in March. Ex-Ukraine pig iron deals, which had been concluded in March in the range of $370-380/mt FOB, have been concluded at $380-390/mt FOB in April and these levels are still valid this week.

Meanwhile, the domestic pig iron prices of steelmaker Kardemir in Turkey - one of the target markets for CIS suppliers - have indicated no changes this week following the upward price adjustment made by the mill last week.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.