The pig iron market in Europe witnessed quieter activity in August as compared to previous months due to the summer holidays in the region, while purchase activity will likely improve in the current month. Ukrainian pig iron offers to Italy, the biggest importer of pig iron from the CIS market, are ranging at $425-430/mt CIF.

Meanwhile, the pig iron market in Turkey is still characterized by silence, while prices are stable. Accordingly, ex-Ukraine pig iron offers to Turkey stand at $420-425/mt CFR Istanbul.

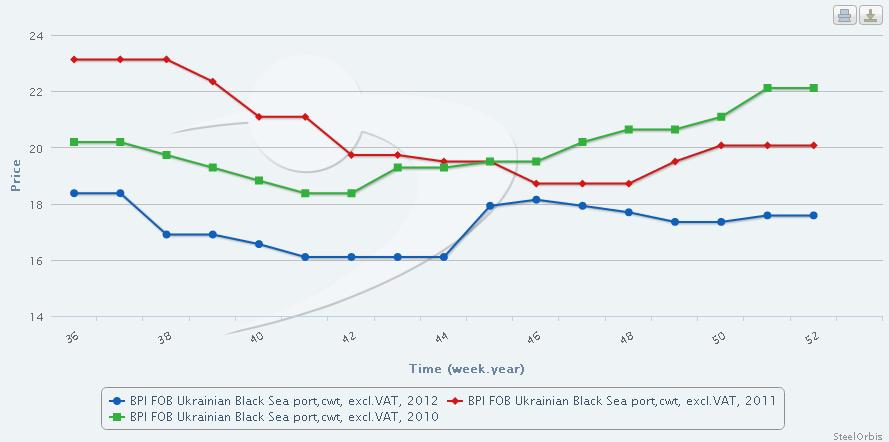

Even though market sources predict that pig iron prices may indicate increases in the short term, according to the SteelOrbis reference price trends for the last three years pig iron quotations have generally trended down during the months of September and October, while later registering increases as the end of the year approaches.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.