After Nucor finally unveiled its decision on rebar prices for October, other mills followed suit and inspired a flurry of buying activity at already-higher levels.

It seems as if Gerdau Long Steel North America was not entirely unsuccessful in its attempt to jump the gun with an early price increase announcement before the scrap pricing trend for September was clear. Their original $1.00 cwt. ($22/mt or $20/nt) increase effective Sept. 19 was not only matched by Nucor and SDI (with October 1 effective dates), but enhanced with Nucor's interesting decision to further increase 20-foot length rebar products by an additional $0.50 cwt. ($11/mt or $10/nt). Of course, Gerdau quietly told customers that their originally-announced increase would now be effective as of October 1, instead of Sept. 19, but it seems as if they, along with the other mills, have already been able to increase spot prices since Nucor's announcement.

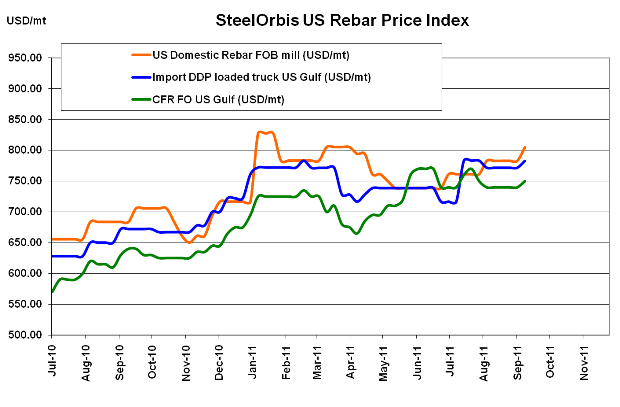

Despite no noticeable uptick in demand (and no boost from raw materials, as shredded scrap moved sideways), US domestic rebar prices have already jumped up $1.00 cwt. in some regions, while others have increased by slightly less. In general, however, the spot range for most US mills has moved up to $36.00-$37.00 cwt. ($794-$816/mt or $720-$740/nt) ex-mill, and sources tell SteelOrbis that it will not be long before 20-foot products prices absorb their full $1.50 cwt. ($33/mt or $30/nt) increase.

Import rebar sources are following the US lead, with offer prices on a strong uptrend. Turkish mills wasted no time in raising rebar offers to the US by a slight $0.50 cwt., putting new offer prices into the range of $35.00-$36.00 cwt. ($772-$794/mt or $700-$720/nt) DDP loaded truck in US Gulf ports. However, US buyers are not exactly interested in import offers so close to US domestic prices, so for now, overseas booking activity will likely remain quiet.

On the other hand, Mexican mills--which typically mirror US price movements--did not make any official announcements immediately after Nucor's but sources tell SteelOrbis that a $1.00 cwt. increase can be assured within the next week. Until then, official offers are still in the range of $34.00-$35.00 cwt. ($750-$772/mt or $680-$700/nt) DDP loaded truck delivered to US border states, but Mexican mills are holding off on booking orders at that price for the time being.