Although at least one US mill has dropped transaction prices by $1.00 cwt. for June, sources say it likely will not affect sluggish purchasing activity.

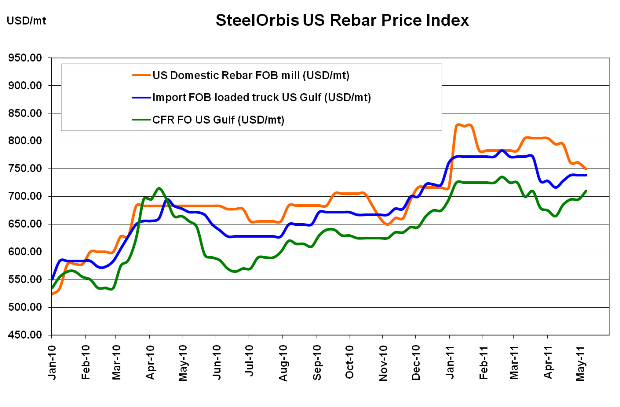

As many expected, the pressures on the US rebar market were too strong to let another month go by with neutral mill asking prices. Nucor announced late Tuesday a decrease in the raw material surcharge (RMS) and no change in base prices for June, effectively dropping official asking prices by $1.00 cwt. ($22/mt or $20/nt). Technically, mills have not been getting their full asking prices since mid-April, when spot prices firmed up to the level of $36.00-$37.00 cwt. ($794-$816/mt or $720-$740/nt) ex-mill. Since then, spots have ticked down week after week, settling this week in the $33.50-$34.50 cwt. ($739-$761/mt or $670-$690/nt) ex-mill range (a difference of $0.50 cwt. since last week). Including the recent transaction price drop into the equation, current spots are still about $1.50 cwt. ($33/mt or $30/nt) less than official asking prices will be in June. Moreover, sources tell SteelOrbis that mills are encouraging customers to make "reasonable offers," with a strong indication that some deals are available for certain customers below the aforementioned spot range.

The "let's make a deal" tactic being employed by US mills is very similar to the one Mexican mills have been using for the past few weeks. Pricing for Mexican rebar is still very negotiable, with deals heard in the level of $32.25-$32.75 cwt. ($711-$722/mt or $645-$655/nt) duty paid FOB delivered to US border states. However, the margin between such import offers and US domestic spots is not incredibly attractive, and with depressed demand levels in the US, there has not been an abundance of import inquiries from US customers.

The story is the same with overseas offers as well, but at least in the case of Turkish offers, price is more a factor than demand. In the local Turkish market, rebar prices are on the rise-but traders tell SteelOrbis that attempts by Turkish mills to increase offers to the US have been virtually ignored. Currently, offers are still in the range of $33.00-$34.00 cwt. ($728-$750/mt or $660-$680/nt) duty paid FOB loaded truck in US Gulf ports, reflecting no change since last week, and also not reflecting the higher CFR prices reported this week. Sources tell SteelOrbis that traders are currently selling stock blocks with tags closer to $32.50 cwt. ($717/mt or $650/nt), but even sales activity at that level is lackluster.