Neutral price trends, stable demand levels and mild import activity will likely continue to define the US wide flange beam market for at least the next month, and possibly beyond.

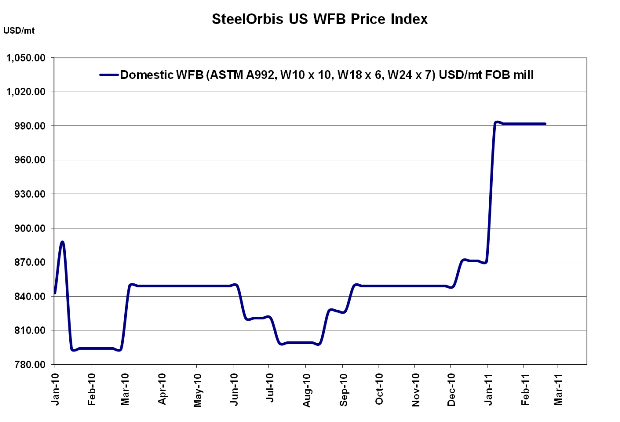

Although US domestic wide flange beam (WFB) prices were caught up in the January scrap pricing wave, rising $3.25 cwt. ($72/mt or $65/nt) for February shipments, prices have settled since then, with an expectation of continued stability for the remainder of the first quarter. March shipment prices did not change from February, and even if scrap pricing dips slightly next month as predicted, WFB mills will almost certainly maintain the status quo for as long as they can.

For now, WFB prices are listed at $45.00 cwt. ($992/mt or $900/nt) ex-mill (for ASTM A992, W10 x 10, W18 x 6, and W24 x 7). Domestic mills have had no trouble getting full asking prices, and distributors have not been putting too much effort into being ultra-competitive because end-use demand doesn't exactly warrant it--aside from some end-use activity bright spots in the Pacific Northwest and Texas, the overall US demand situation is defined by small, steady jobs requiring mostly small orders. In late January, there was a measurable uptick in overall WFB purchasing activity, but sources tell SteelOrbis that it was mostly due to distributors buying ahead of the $3.25 cwt. increase.

This is illustrated in the latest MSCI Metals Activity Report, which stated that month-ending beam inventories spiked in January, rising to 530,300 nt from 502,200 nt in December. However, monthly shipments also increased, from 198,800 nt in December to 218,500 nt in January. Both figures represent the highest numbers since September 2010, and if the buying activity in January was primarily stock-influenced as suspected, shipment levels should reflect a drop in February. Nevertheless, there are optimists in the market who believe that steady demand levels will keep inventories and shipments in balance for the next few months.

Mild domestic activity has also led to a decline in imports, even though import prices from top source Korea have maintained a comfortable 10-12 percent margin below domestic prices. Import levels overall have been on a downward trend since last October--with only a few more business days left in February, beam imports to the US are approximately 10 percent less than January levels, according to import license data from the US Import Monitoring and Analysis System (SIMA). Of February's current total tonnage of 6,887 mt imported into the US, 4,291 mt came from Korea and 1,363 came from South Africa-no other country provided more than 1,000 mt of beams for the month. Notably absent from the major-source list is Luxembourg, which has only exported 283 mt of beams to the US so far this month, compared to 1,133 in January. Until US domestic demand shows significant improvement--primarily in the heavy construction arena--import beam levels will continue to tick downward.