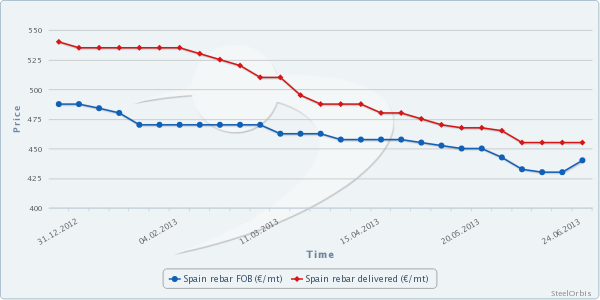

Spanish long steel mills' domestic rebar prices have remained unchanged over the past two weeks at €450-460/mt ($584-597/mt) for deliveries to customer, while Spanish rebar export offers have risen by €10/mt ($13/mt) as compared to last week, reaching €435-445/mt ($564-577/mt) FOB. This increase came as a result of the strengthening of the US dollar against the euro and higher demand from buyers, who believe that rebar prices have already reached the bottom. In the meantime, Spanish rebar export offers to Algeria are standing at €448-450/mt ($581-584/mt) CFR and these offers seem likely to reach €455/mt ($590/mt) CFR towards the end of the current month.

European rebar offers may face increased pressure in the Algerian market in the coming period, since Turkish steel group Tosyalı has started rebar production in Algeria and is now capable of selling rebar on ex-works basis at prices below Spanish offers.

As SteelOrbis has previously reported in early June, Turkish steelmaker Toscelik had inaugurated its new rebar facility in Oran, Algeria. The steel products portfolio of the plant includes billets, rebars and merchant bars. The whole production is supplied to the Algerian market, as replacement for imports.

Toscelik's new facility is Algeria's largest steel plant with an annual liquid steel capacity of 1,250,000 mt. 900,000 mt of annual rebar production and an annual turnover of $1 billion are expected at the plant.

€1 = $1.297