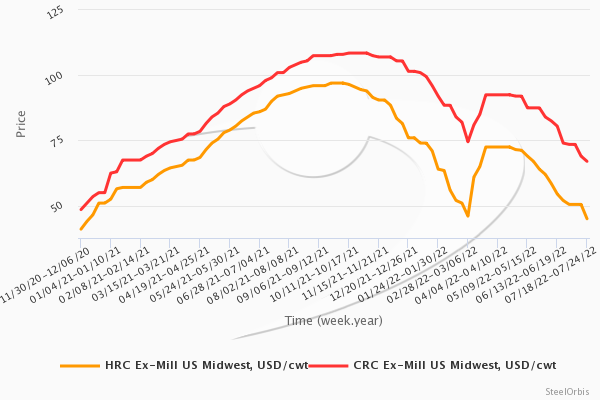

Spot market prices for US domestic hot and cold rolled coil have continued to fall since our last report a week ago, as US HRC prices are now at their lowest level since December 2020.

Current HRC prices are now trending at $44-$45 cwt. ($970-$992/mt or $880-$900/nt), FOB mill, against $45.50-$47.50 cwt. ($1,003-$1,047/mt or $910-$950/nt), FOB mill, a week ago. Sources close to SteelOrbis said that while some deals are taking place below this range, they are not aware of any transactions that are taking place at or below $40 cwt. ($882/mt or $800/nt) FOB mill.

This is the lowest HRC prices have been since December 2020, when deals for hot rolled coil were being heard at $41 cwt. ($904/mt or $820/nt), FOB mill.

CRC, on the other hand, is trending a bit differently. While the “official” spot market range for US domestic cold rolled coil is being reported at $66-$68 cwt. ($1,455-$1,499/mt or $1,320-$1,360/nt), FOB mill, (which reflects a $2.00 cwt. ($44/mt or $40/nt) dip from prices heard a week ago), deals anywhere between $7-$10 cwt. ($154-$220/mt or $140-$200/nt) have been heard throughout the marketplace.

This is the lowest CRC prices have been since January 2021, when CRC prices were recorded at $68 cwt. ($1,499/mt or $1,360/nt), FOB mill.

And while some believe that prices are likely to bottom at some point in August, others still feel that overall market fundamentals will continue to put pressure on the market.

“I’m seeing an eventual floor price that’s right around $35 cwt. ($772/mt or $700/nt),” a source said. “I think the crash will be over soon, and that the big declines are over, but I think that prices are going to ease the rest of the way down. If you look at input costs and overall market fundamentals (not to mention the enormous amount of new capacity that’s coming online this year), HRC is still overpriced.”

On the other hand, record breaking temperatures throughout the US, including states such as Texas and Indiana could throw a wrench into that calculation.

The Texas power grid operator has already put out several calls to Texas to ease their electricity use, and news reports out of Indiana have warned that rolling blackouts could be on deck for the summer. (Parts of Texas are on track to have the hottest July in history, and early-July, temps in Indiana reached 99 degrees in many parts of the state.)

“There are big problems with the power grid in [those states], and if things get really bad we could see power cuts to steel mills in [Texas and Indiana] including SDI and Cleveland Cliffs, among others,” a source said, noting that in late 2021, steel mills in Europe, China, and Iran were subject to electricity restrictions.

Consequently, if US temperatures remain high, and residential power consumption needs to be prioritized, this could impact EAF production.

“I do think there’s a risk to supply, which would lead to an upside to price,” the source said. “Because the EAFs won’t be able to produce steel if their energy gets cut.”