The effects of the financial crisis have already started to be felt in the real sector. Export levels are declining in many sectors, and the rising unemployment rates provide sufficient evidence of the general economic downturn. As regards the stainless steel sector, what happens in the construction sector in particular, and also in the automotive, white goods, kitchen appliance and shipbuilding sectors, has a direct impact. Consequently, the sluggishness seen in all of these sectors has caused a decline in stainless steel consumption, resulting in the disparity between supply and demand. All firms in the real sector complain of the same difficulties - decreasing trading activities due to the financial crisis, reluctance on the part of banks to lend money and a general shortage of cash - with the result that business activity has nearly drawn to a halt.

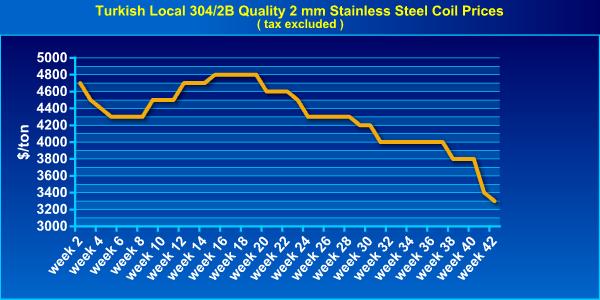

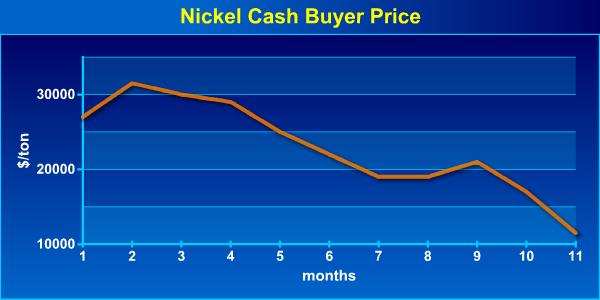

This shrinkage of business activity has led producers in the real sector to rollback their production outputs. However, the effects of the shrinkage will be felt strongly with the conclusion of the current month. In the graphs below there are presented the price changes in stainless steel coil and nickel in Turkey's domestic market from the beginning of the current year. It can be seen that both graphs are trending more or less in parallel to each other, showing the direct impact nickel prices have been having on stainless steel prices.

The decreasing trend in stainless steel prices is continuing and prices have now slipped below the levels seen at the beginning of 2007. This downturn process seen globally will require some time to exhaust itself. The common problem of all real sectors worldwide is the lack of the necessary confidence required to convert existing money into investments.

Currently, the sales prices of ex-Europe stainless steel materials in Turkey's domestic market are as follows:

Product |

Price (Excluding VAT) |

304/2B grade stainless steel |

€2,500-2,700/mt ($3,353-3,621/mt) |

316/2B grade stainless steel |

€3,800-4,000/mt ($5,096-5,365/mt) |

430/2B grade stainless steel |

€1,250-1,350/mt ($1,676-1,810/mt) |