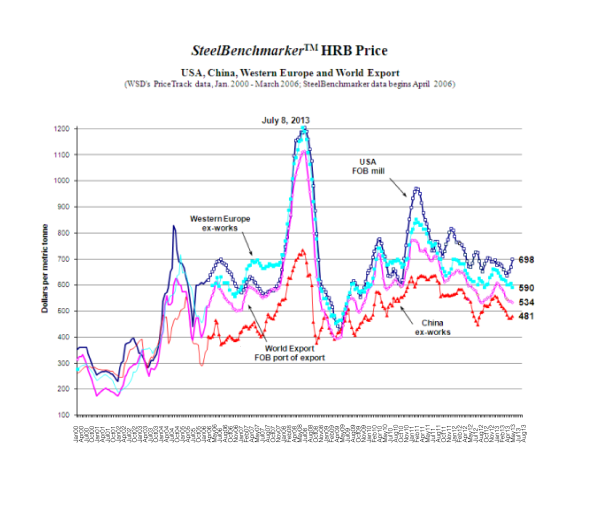

Unlike steelmaker's raw material prices that all reside in the same metallic bathtub - i.e., the price movements are typically in step with one another - steel product prices often do not move in sync with one another when considering the price: a) on the world market; b) in the USA; c) in the Euro zone; and d) in China. The pricing relationships for commodity-grade hot-rolled band have often been "out-of-sync" especially the past few years.

As of July 8, 2013, SteelBenchmarkerTM data indicates that the USA spot price for hot-rolled band was $698 per metric ton ex-works, or $217 per ton above the Chinese price at $481 per ton, ex-works. This spread since 2006 has varied from a low of $4 per ton in June 2009 to a peak of $523 per ton in August and October 2008. On July 8 2013, the world export price was $534 per ton and the Western European price was $590 per ton.

Until a few years ago, WSD was segmenting the groups that exported commodity grade hot-rolled band into four tiers. The Tier IV mill category included the lower-product-quality producing Ukrainian mills and some Chinese mills; both of which often had poor delivery records. Tier III mills include average-product-quality producing mills. The Tier II mills included those producing high quality products; but, they tended to not make steady export offerings over the cycle. The Tier I mills included those making the highest quality products that regularly and reliably offered their product in key export markets. The Japanese steel mills were the best, but not the only, example of the Tier I mills.

In this prior-to-2008 world, the Tier IV mills' hot-rolled band price might have been offered at a $40-50 per ton discount, FOB the port of export versus the Tier I mills. The Tier III mills were selling at perhaps a $20 per ton discount; and, the Tier II mills at a $10 per ton discount.

Since the collapse of the global steel market in the second half of 2008, much has changed. WSD now sees only three tiers of mills when it comes to commodity HRB offerings on the world market. The Tier III mills - the lowest tier mills - remain the Ukrainians whose tolerances and coil sizes are less desirable than the others; although, they now have a good record for on-time delivery, say our contacts. These mills may sell their product on the world market at a $25-30 per ton discount from the Tier I mills. The Tier II mill category, that currently includes some of the Russian steel mills, often sells at the next lowest price - perhaps because they are both low cost and highly export dependent, but not because of below-average product quality. They may sell at a $10-20 per ton discount to the Tier I mills. The Tier I mill category now includes many of the steel mills in the world that make the highest quality product.

Since the fall of 2012, there's been an ongoing shift in which mills are offering hot-rolled band at the lowest price on the world market, say our contacts. In about September 2012, for example, WSD's feedback indicates that the Chinese mills had the lowest price (taking over from the Russian mills). Then, after the Chinese and Russian mills raised their price, the Japanese and South Korean mills in a number of cases apparently had the lowest price. Then, a few months ago, the Russian mills took over the low-price prize; but, it now appears that the Chinese mills have the lowest price - even though they have boosted their export quote to $515 from $505 per ton, FOB the port of export.

The relative price situation in China, regarding the home price versus the world price, has flip-flopped in the past decade as hot-rolled band in China shifted from undersupply to oversupply. Given the vast number of steel mills in China that are now seeking to sell hot-rolled band (about 77 of them), this market is "competitive" in the academic sense of the word. The Chinese home-market ex-works price, notwithstanding the recent moderate rally, is now the lowest in the world.

For additional information of WSD's services, please contact us at:

wsd@worldsteeldynamics.com

Or visit our website at:

www.worldsteeldynamics.com