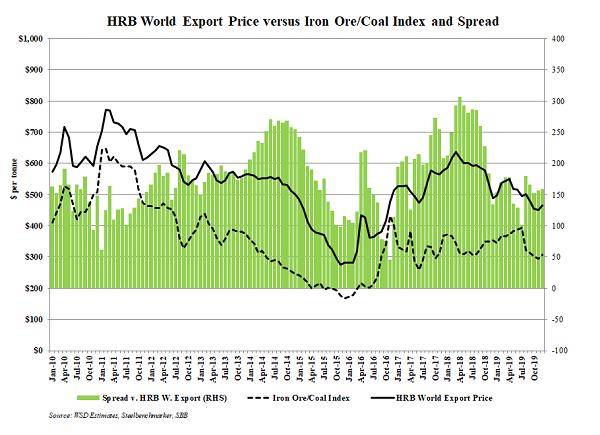

As indicated in the accompanying exhibit, we compare graphically: a) the HRB export price; and b) the BF cost index for iron ore and coking coal. These items from 2010 to 2016 tended to be in sync. But, starting in 2016, the hot-rolled band export price rose far more sharply – at least through early 2018. Since then, the weighted iron ore and coking coal BF cost index has fallen more sharply.

In early 2011, the premium for the HRB price over the BF cost index was narrowed. However, the opposite was the case when the HRB export price peaked in early 2018.

In early 2011, the premium for the HRB price over the BF cost index was narrowed. However, the opposite was the case when the HRB export price peaked in early 2018.

As of December 2019, the premium for the HRB world export price versus the BF cost index is about $158 per tonne, which is not an atypical figure looking back to 2010.

Looking ahead, major swings in the HRB price, the BF cost index and the “spreads” can be expected.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2019 by World Steel Dynamics Inc. all rights reserved