China – Repairs to the “Bus” Badly Needed

Building on WSD’s long-running metaphor of the Chinese economy and its steel industry “Driving the Bus” of global trends, it’s quite apparent that the recently crashed “Bus” is now badly in need of repair. The question is: how long will it take to fix it, and will it ever run as fast as it did in the past? As WSD sees it, the list of repairs is long and substantial-enough where it could take some time, possibly a full year, before China’s property sector – the “engine” of China’s steel industry and a key component of the overall economy – is revived into a working condition. The most-recent list of factors influencing the situation is as follows:

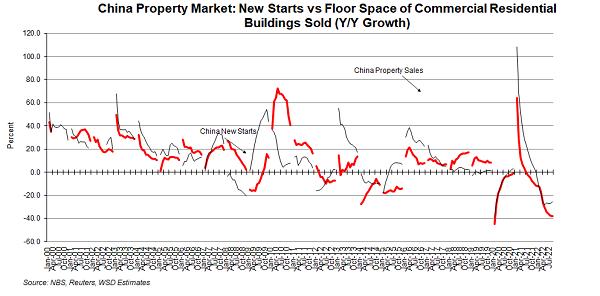

- Sales of new homes continued to deteriorate rapidly in September of 2022, down 26% versus one year prior, albeit slightly better than the August figure of -27% on the same basis:

-

- This comes despite a recent easing of mortgage rates – unprecedented in its scale – as well as a number of policy tools deployed in the past few weeks aimed at loosing credit to the beleaguered sector

-

- In addition to improve homebuying credit conditions, China’s central government policymakers have ceded decision-making control over property policies to local governments, including down-payment ratios and other items

- The real crisis, especially from the viewpoint of steel consumption, continues when it comes to new housing projects, which continued to plummet ~38% on a year to year basis in September (versus 37% in August). Year to date, the decline stands at ~29%

-

- According to some reports, LGFVs (Local Government Financing Vehicles) – entities generally responsible for funding local government infrastructure projects, have been ordered to purchase land from local municipalities as a means of back-stopping a brewing fiscal crisis at the local government level. This is an effort to offset the massive decline in local government revenues, 20-40% of which have been tied to land sales to real estate developers in recent years. As these developers suffer from a debt crisis, LGFVs are “plugging the hole” in local government budgets for the time being. This, of course, portends poorly for the future possibility of actually construction ever unfolding on the land sold under these circumstances, as LGFVs are not well equipped to turn their recently acquired land into housing projects.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non -public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2022 by World Steel Dynamics Inc. all rights reserved