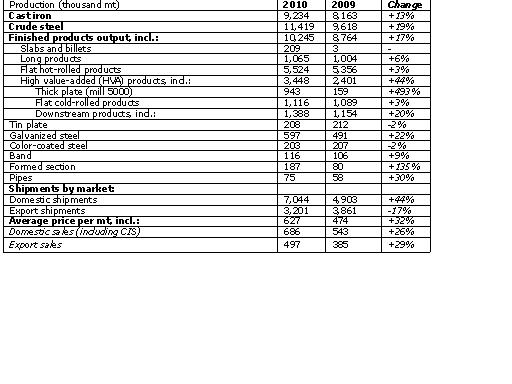

The Russian steelmaker Magnitogorsk Iron and Steel Works (MMK) has announced that in 2010 it increased its crude steel production by 19 percent year on year to 11.4 million mt, while its finished steel product output went up by 17 percent year on year to 10.2 million mt, due to the recovery of the global and Russian economy, as well as due to the development of new product types at MMK.

In 2011, MMK intends to increase crude steel and finished steel outputs by 14 percent and 17 percent year on year, driven by strong demand for its products from the major steel consuming sectors in Russia. Overall steel consumption in Russia is expected to increase by at least 10 percent year on year in 2011.

In 2010, MMK continued to increase its domestic sales due to growing demand from the main steel consuming sectors of the Russian economy. MMK estimates its share in total Russian rolled steel production at 17 percent. MMK's domestic sales in 2010 rose by 44 percent year on year to 7 million mt, exceeding the growth rate of domestic consumption. MMK managed to achieve these results thanks to its import replacement strategy according to which it has developed unique steel product types which are in demand in the domestic market.

In 2010, the share of MMK's shipments to the domestic market of its total shipments rose by 13 percentage points year on year to 69 percent, which is a record for the company. The increase in its domestic shipments corresponds to MMK's strategy of increasing its presence in the markets which offer premium prices. MMK's average domestic price per metric ton of steel products in 2010 was $686, exceeding the average export price of $497/mt by $189/mt.