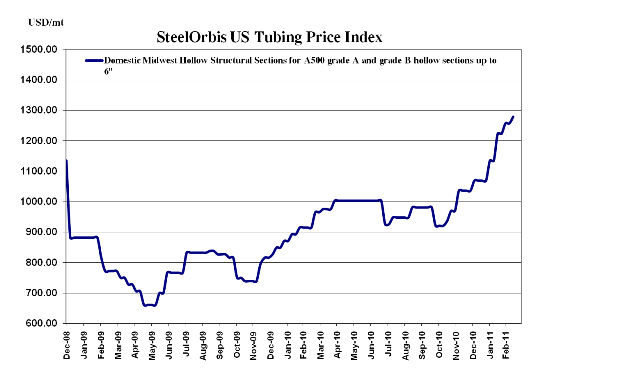

Spot prices are on their way up in the tubing market as late February-announced price increases begin to take effect.

Spot price ranges for hollow structural sections (HSS) have widened this week, as a few last-minute orders are being placed before the marketplace fully absorbs the February 28-announced $60/nt price increase. Certain Midwest tubing mills with lower-cost hot rolled coil (HRC) still available are reportedly quoting approximately $56.00 cwt. ($1,235/mt or $1,120/nt) ex-mill on the spot market, however those offers look to only be available for the next week. For the most part, spot prices are now $57.00-$59.00 cwt. ($1,257-$1,301/mt or $1,140-$1,180/nt) ex-Midwest mill now, which reflects a $1.00 cwt. ($22/mt or $20/nt) increase since late February/early March.

While there appears to be some room for malleability in mill prices at the moment for large tonnage orders, with HRC prices only continuing to rise-albeit slowly-spot price ranges for HSS are expected to firm by late March with spot prices moving closer to $60.00 cwt. ($1,323/mt or $1,200/nt) ex-Midwest mill as the month progresses. Overall order activity, which has definitely softened since February, is still somewhat steady for the most part; however, the size of orders being placed at current prices has decreased. Many distributors are choosing to keep inventories lean and only buying the bare minimum, citing that no one can afford to get stuck with high priced steel when spot prices begin declining in late Q2.

On the West Coast, buyers are being quoted around $59.00-$60.00 cwt. ($1,301-$1,323/mt or $1,180-$1,200/nt) ex-mill, although spot prices are closer to the $57.00-$58.00 cwt. ($1,257-$1,279/mt or $1,140-$1,160/nt) ex-mill range. Compared to the Gulf Coast, supply of HRC is relatively tight, with flat-rolled mill order books closing within a week of opening over the past two months. And so, West Coast buyers are having less room to negotiate for larger tonnages than their Midwest and Southeast counterparts.

There is no doubt that spot prices will continue to climb through the end of Q1, but the biggest concern now is if, or when, there is another increase, whether or not the market be strong enough to absorb it without order activity slowing down almost entirely. Buyer pushback is rising, and although there is justification for recent price increases (HRC spot prices are now around $43.00-$45.00 cwt. ($948-$992/mt or $860-$900/nt) ex-Midwest mill), demand levels simply cannot sustain HSS spot prices at $60.00 cwt. ex-mill. And while prices are projected to stay high along with flat-rolled prices through much of Q2, any sign of softening-now expected in late May/early June-could send HSS prices tumbling.

With the persistent fear that the higher prices climb, the faster they will come down, import activity remains silent with the exception of competitive Mexican offers. The domestic Turkish tubing market is strengthening, and Turkish HSS offers are up $2.00 cwt. ($44/mt or $40/nt) on the low end and $1.00 cwt. on the high end since late February and now range from $53.00-$54.00 cwt. ($1,168-$1,191/mt or $1,060-$1,080/nt) duty-paid FOB loaded truck in US Gulf ports for May delivery. South of the border however, Mexican mills are offering HSS at $50.00-$51.00 cwt. ($1,102-$1,124/mt or $1,000-$1,020/nt) FOB loaded truck in US Gulf ports and $53.00-$54.00 cwt. FOB loaded truck in US West Coast ports for early April delivery, which is collecting significant interest from US traders.