Despite the efforts of steelmakers to cut their production costs, coke prices in China have moved sideways this week. Moreover, with some downstream users having remained out of the market after the Lunar New Year holiday, coke trading in China has remained muted.

Specifically, first-grade coke prices in Tangshan are at RMB 2,840/mt ($421.5/mt) ex-warehouse, moving sideways compared to January 20, according to SteelOrbis’ data.

Prices of coke in local markets in China

Product Name |

Specification |

Place of Origin |

Price(RMB/mt) |

Price ($/mt) |

Weekly Change(RMB/mt) |

Weekly Change($/mt) |

Coke |

First grade (A<13.0,S<0.75,CSR>65.0) |

Hancheng,Shaanxi |

2,830 |

420.0 |

0.0 |

2.0 |

Zibo ,Shandong |

2,970 |

440.8 |

0.0 |

2.1 |

||

Pingdingshan,Henan |

2,740 |

406.6 |

0.0 |

1.9 |

||

Tangshan |

2,820 |

418.5 |

0.0 |

2.0 |

||

Huaibei,Anhui |

2,840 |

421.5 |

0.0 |

2.0 |

||

Average |

2,840 |

421.5 |

0.0 |

2.0 |

including 13 percent VAT

Meanwhile, in the coking coal segment, a booking for ex-US premium high volatility hard coking coal has been done at $310/mt CFR China, with March loading. The price is in line with offers which have been heard during recent weeks. A few cargoes of ex-Russia low-volatility pulverized coal injection (PCI) are reported to have been booked at $239-240/mt CFR China, with early February laycan, up around $3-4/mt from the levels in deals in late January.

In the meantime, market players have continued to follow developments in Australia-China relations. After the cancellation of the unofficial ban on Australian imports, which came into effect in October 2020, China is expected to take its first shipment of ex-Australia coking coal in the coming days. According to one source, a cargo of 72,000 mt of coking coal from Australia is anticipated to arrive at Zhenjiang Port in south China’s Guangdong Province on February 8. Consequently, Chinese coking coal buyers have mostly opted to take a breather from bookings, evaluating market developments and future prospects. With supply to China increasing, global coking coal sellers may be forced to offer more competitive prices to obtain the interest of Chinese customers.

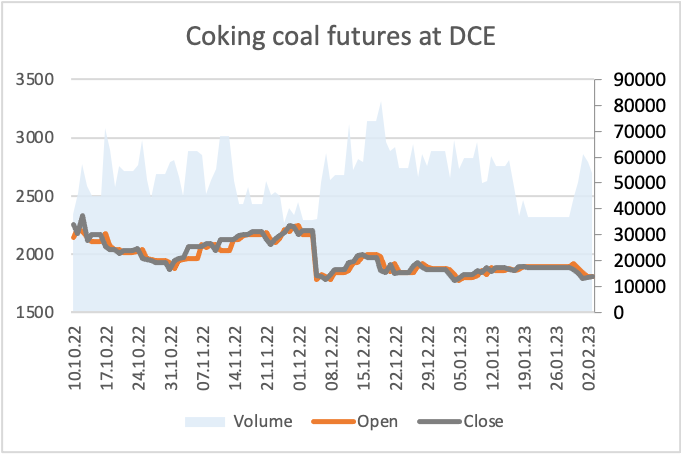

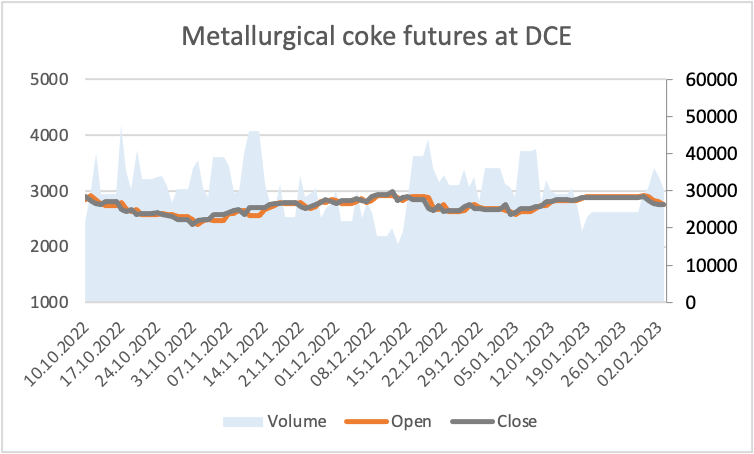

As of Friday, February 3, coking coal prices at Dalian Commodity Exchange (DCE) have settled at RMB 1,812/mt ($269/mt), down four percent compared to January 20. Meanwhile, coke futures prices have declined by RMB 132/mt ($19.6/mt) or 4.6 percent during the same period, to RMB 2,757/mt ($409/mt).

$1 = RMB 6.7382