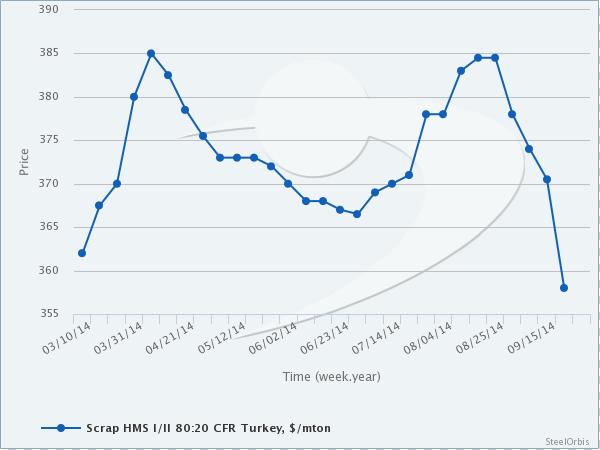

The Turkish import scrap market has remained quiet in the past week, witnessing only two bookings. During the past week, an ex-US HMS I/II 80:20 scrap deal has been concluded at $368/mt CFR, softening by $1-2/mt as compared to the previous transaction level recorded one week earlier. Meanwhile, an ex-Baltic scrap booking has been concluded at the average price level of $358/mt CFR, also in the past week, for a cargo consisting of HMS I/II 90:10, HMS I/II 70:30, shredded scrap, bonus grade scrap and busheling scrap. As for the current week, an ex-St. Petersburg HMS I/II 80:20 scrap booking has been concluded at $351/mt CFR early this week. No other import scrap transaction has been heard this week besides the one from St. Petersburg.

According to the consensus reached at the SteelOrbis 2014 Fall Conference & 71st IREPAS Meeting taking place in Berlin on September 29, with the participation of almost 300 executives, including 82 representatives from 43 steel producer companies from a total of 21 countries and 48 representatives from 33 raw material suppliers, global scrap prices, which have seen the lowest levels of the past six months, have not bottomed out yet and this downtrend will likely continue for another while. These downward expectations are attributed to weak finished steel demand and continuing decreases in global iron ore prices. After recently dipping below the $80/mt CFR China threshold, ex-Australia 61.5 percent Fe content iron ore prices have declined further and as of yesterday, September 29 have decreased to the $78/mt CFR China mark. This indicates that attractive Chinese billet export prices will likely maintain their advantage in the coming period, while it also strengthens expectations of further price declines in the Turkish import scrap market. On the other hand, after the Feast of Sacrifice (October 3-7) the import scrap bookings of Turkish buyers are expected to accelerate. Meanwhile, market sources also inform SteelOrbis that some scrap transactions may be concluded on the sidelines of the IREPAS event in Berlin.