Although domestic mills have not made any determinations about November wire rod pricing, all signs point to a transaction price decrease.

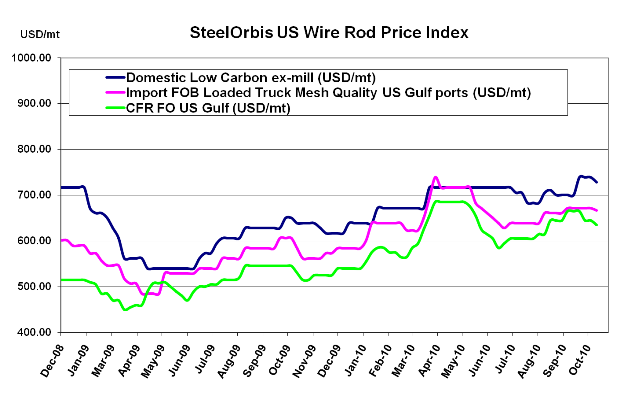

US wire rod mills did not have much success with their most recent price hike last month-on average, customers only accepted about $0.50 cwt. ($11/mt or $10nt) of the $1.50 cwt. ($33/mt or $30/nt) increase. This has led many to speculate that mills will have no choice but to respond to the recent $30/long ton decrease in shredded scrap with an official wire rod pricing decrease of at least $1.00 cwt. ($22/mt or $20/nt), if not more. Currently, the "unofficial official" transaction price range is $32.50-$33.50 cwt. ($717-$739/mt or $650-$670/nt) ex-mill, but the market has been described as a "free-for-all" in which mills are accepting most inquiries at $32.50 cwt. or under.

Domestic demand for wire rod is still anemic, with some end-use sectors not doing as well as expected. The US automotive industry, for example, touted increased sales in September, but only compared to sales last year, after the Cash for Clunkers program ended. While the big three automakers (Ford, GM, Chrysler) sold a total of 434,105 cars in September 2010, up about 39 percent from September 2009, they sold 442,035 in August 2010, reflecting a month-on-month decrease of approximately 1.5 percent. As for the construction sector, the outlook doesn't seem to be getting any better-recent data from the US Labor Department indicate that the unemployment rate for construction rose to 17.2 percent in September from 17 percent in August.

As for imports, activity from Turkey has been slow, mostly due to the weakening dollar against the Turkish lira. Turkish mills are not willing to cut prices to a level acceptable to US customers, so even though most offers have dipped slightly in the last week, by about $0.25 cwt. ($5.50/mt or $5/nt), there are little to no transactions being concluded at the new price range: $29.75-$30.75 cwt. ($656-$678/mt or $595-$615/nt) duty paid FOB loaded truck in US Gulf ports.