The recent price increase announced by domestic wide flange beam (WFB) mills has done nothing to spur activity in the market.

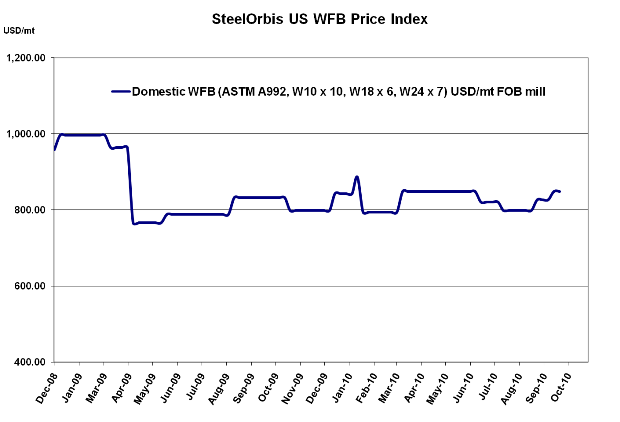

Although WFB mills boosted prices by a modest $1.00 cwt. ($22/mt or $20/nt) in reaction to the $28/long ton shredded scrap increase earlier this month, they are not expecting to see much activity in response, especially considering that they didn't sell much of the previous price increase. While listed prices for October shipments will be $38.50 cwt. ($849/mt or $770/nt) ex-mill (for ASTM A992, W10 x 10, W18 x 6, and W24 x 7), deals are still being cut for around $1.00 cwt. less to service centers, who are selling to their own customers at or below published mill prices. Nevertheless, scrap prices for October, which are currently predicted to drop by $10-$20/long ton, are not expected to have much effect on WFB prices. If domestic mills decrease prices at all next month--they could also go flat--they will probably only absorb half of the scrap decrease.

The overall demand situation for WFB is tepid at best, with most service centers selling to small projects such as shoring jobs and custom homes. However, there is a bright spot on the horizon for beam demand. According to a recent report from the US Department of Commerce (DOC), new housing starts rose 10.5 percent in August, compared to a revised 0.4 percent increase in July. The uptick was bolstered by a 32.2 percent boost in multi-family (apartment building) starts. Additionally, permits for new construction, which many economists believe to be a more accurate gauge of home building, increased 1.8 percent in August. Permits for condominiums and apartments, which are a key WFB end-use sector, increased by 9.8 percent. While the Midwest and Eastern US will not likely see much construction starts in the pre-winter months, the DOC data should give beam producers and service centers reason to be optimistic for 2011.

Overall, most US beam buyers are continuing to stick with domestic purchases, as they have for the past few months. Inventory levels at many service centers are getting uncomfortably high, so purchasing managers are in no mood to buy product that won't arrive until the fourth quarter. Deals from Korea reported last month have virtually dried up, and European offers are still too high for anyone in the US to take notice.

Accordingly, import data from the US Import Monitoring and Analysis System (SIMA) show a significant drop in imports in August, and September levels are even worse. License data show that the US imported 9,691 mt of WFB in August, compared to a much more robust 20,020 mt in July. And as of this week, the US has only imported 5,806 mt of beams for September, with the vast majority coming from Luxembourg (3,297 mt). While Luxembourg was the source of a decent amount of beams to the US in August as well (2,692 mt), it was number three under Korea (2,735 mt) and Spain (3,477 mt). So far this month, the latter two countries have only exported 1,192 mt to the US combined.