The European rebar markets were in general characterized by silence last week. It does not seem possible to say that the price uptrend observed in recent weeks on the Turkish producers' side has influenced Europe. Although the European producers also wanted to increase their prices in the past week, the current low demand level has not allowed them to do so.

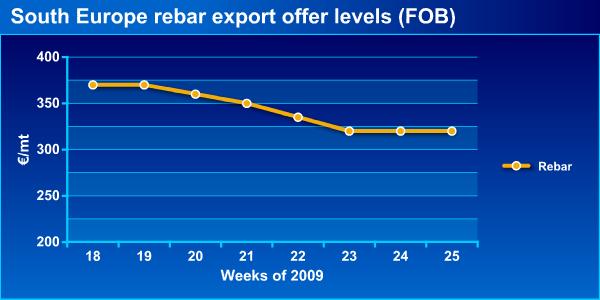

No change has been observed in the price levels of concluded deals in Spain after the adjustments of base and extra prices in recent weeks. Although the Spanish producers were seeking to increase the prices last week, due to low demand they have not yet been able to achieve this. However, a softening in rebar prices was observed in Portugal last week to around the level of €345/mt delivered to customer, excluding VAT. In Italy, price levels continued to vary depending on the regions and in general were at €320-330/mt ex-works, excluding VAT. Price levels have also shown variation in Greece depending on customers and tonnage. End-user demand for rebar generally continued at low levels in the abovementioned European countries also last week. On the export side of these southern Europe countries, the latest deals to Algeria, which is the most important rebar export market of the southern European countries, were at around €320/mt FOB.

In the last week, demand remained at low levels in the western, central and eastern regions of Europe. While the tonnages in concluded deals were small, price levels have continued to show variation depending on payment terms. On the other hand, in the countries that import rebar from Turkey, the price levels in their local markets have not been influenced by the price uptrend in Turkey.

Meanwhile, in the UK rebar producers decreased their price levels mainly due to the price downtrend in import rebar offers. However, the price gap between list prices and sales price levels still exists in the UK.

In conclusion, the European rebar markets were in general characterized by silence in the last week. While export offers were at lower levels compared to local market prices, European rebar producers have continued to offer rebars at competitive levels in their local and export markets.