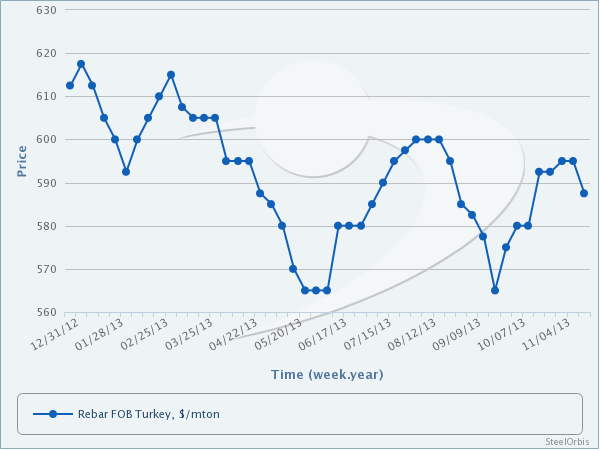

SteelOrbis has learned from market sources that rebar export offers from Turkey softened by $10/mt earlier this year to $580-595/mt FOB. However, with the new rebar transactions from Turkey to Egypt concluded today, November 22, Turkish producers have again increased their offers to $590-600/mt FOB. It is heard that earlier this week rebar transactions from Turkey to Saudi Arabia and the UAE were concluded in the range of $588-590/mt CFR on theoretical weight basis, while rebar sales to Iraq have continued to be concluded at levels of $600-605/mt ex-works.

After the termination of the safeguard investigation regarding rebar and wire rod imports in Egypt, demand in the country for ex-Turkey rebar has increased, while market sources say that rebar transactions from Turkey to Egypt have been concluded at the level of $610/mt CIF on actual weight basis. This demand revival in Egypt, which has been an important export destination for Turkey, has had a positive impact on the Turkish market. Meanwhile, offers at $605/mt CFR are also stated to have gained acceptance in Egypt, but Turkish producers are aiming to ask for higher prices. According to market sources, this situation may support Turkish producers in keeping their rebar export offers at $590-600/mt in the coming period.

Meanwhile, buyers in the UAE, which is Turkey’s second biggest rebar export market, are waiting for announcements of local producers’ price levels for December production in order to focus on import purchases. However, since the stock levels of buyers in the UAE are not so low, ex-Turkey rebar purchase activity in the UAE is unlikely be liven up before January.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.