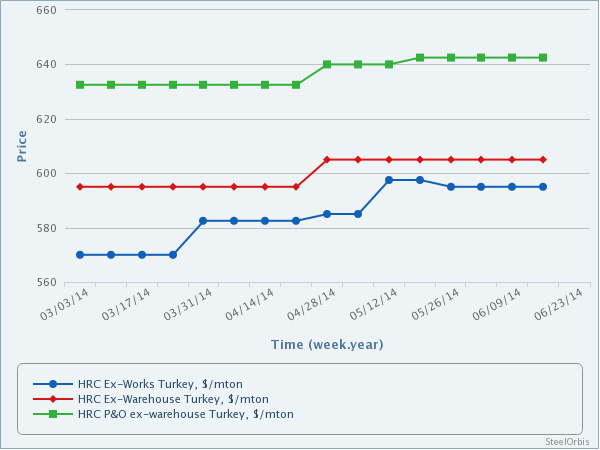

Demand in the Turkish domestic hot rolled coil (HRC) spot market has started to weaken over the past week - having been at medium levels last week - due to the impact of the summer season and the approach of Ramadan. Tightness has continued in availability of hot rolled pickled and oiled coil due to delays in deliveries by producers. Prices are expected to decrease in the HRC market with Ramadan starting at the weekend. On the other hand, traders state that some of their orders for May and June deliveries have been delayed and that, if prices fall as anticipated before the deliveries, they will be in a difficult situation. Meanwhile, prices in the Turkish HRC market have remained stable since last week.

Demand received by Turkish producers has also softened over the past week, though producers have kept their prices unchanged. Additionally, decreasing iron ore prices have also started to put pressure on flat steel prices, even though scrap prices are resisting against downward pressures.

Producers' HRC prices have remained in the range of $590-605/mt mt, while discounts are available to certain buyers and depending on tonnages.

The domestic sales prices of traders for local and imported hot rolled flat steel products in the Eregli and Gebze regions of Turkey are as follows:

Product | Price ($/mt) | |

Eregli | Gebze | |

2-12 mm HRC | 600-610 | 605-615 |

2-12 mm HRC (for large volume sales) | 590-600 | |

1.5 mm HRS | 630-640 | 635-645 |

3-12 mm HR P&O | 635-640 | 645-650 |

The above prices are ex-warehouse and for advance payments, exclusive of 18 percent VAT.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.